The financial sector has witnessed a significant transformation in recent years, altering how users and companies engage with financial institutions and their services. This evolution has been fuelled by a convergence of technological improvements, evolving user behaviors, and regulatory reforms, mainly due to the proliferation of digital finance and mobile applications. These applications, from mobile banking to investment management platforms, have become integral, increasingly digital, and interconnected globally.

Fintech apps have played a pivotal role in democratizing access to financial offerings, empowering customers to control their finances, spend money on markets, and conduct transactions seamlessly cross-border with just a click on their smartphones. Furthermore, fintech apps have brought modern solutions to longstanding demanding situations within the financial ecosystem, including high costs, cumbersome processes, and confined accessibility. Whether harnessing artificial intelligence (AI) to extend customized banking recommendations or leveraging blockchain technology for secure and transparent transactions, fintech apps stand at the frontline of banking innovation, driving efficiency, transparency, and inclusivity inside the financial space.

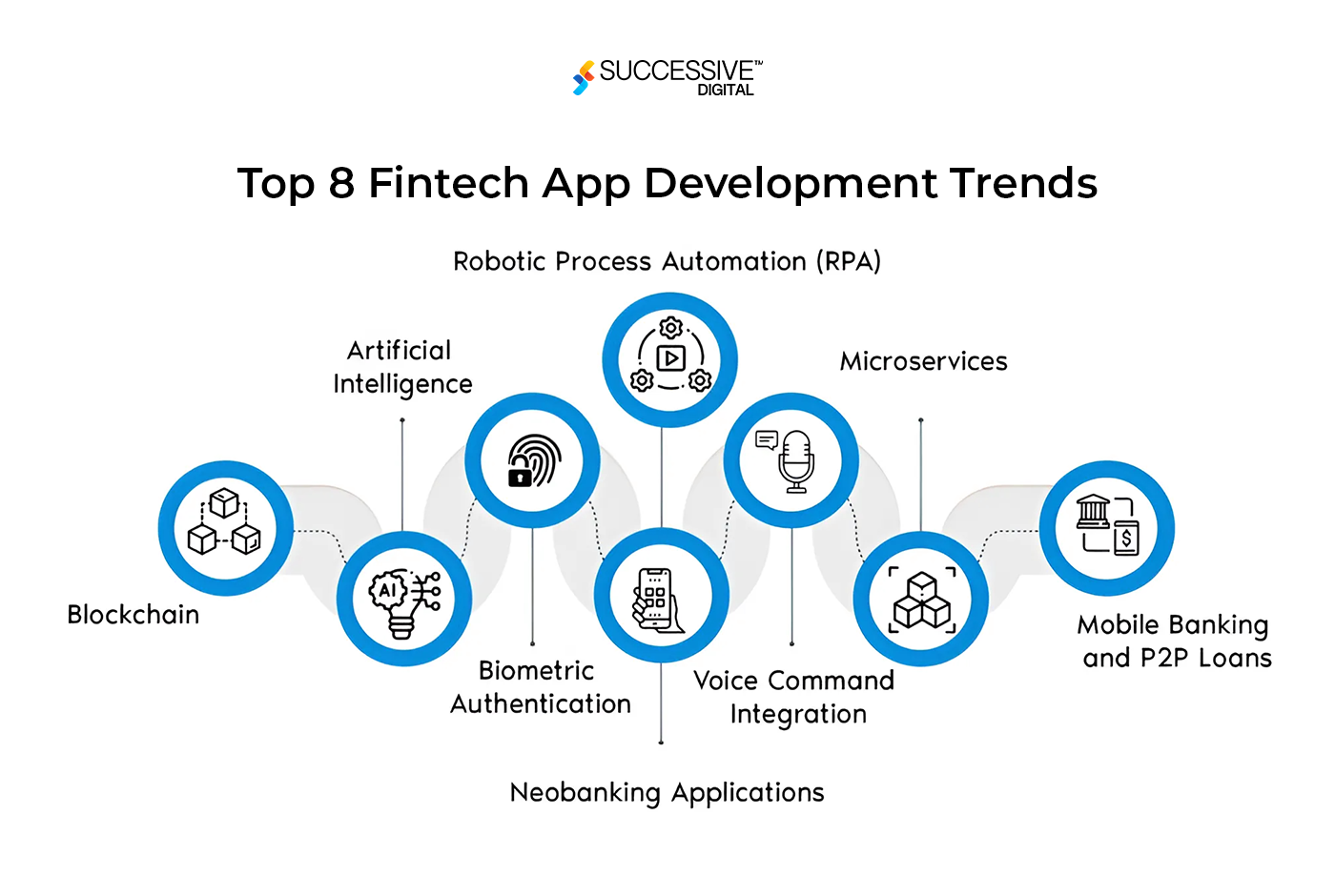

This blog discovers the top trends in the fintech app development and explores how these trends are reshaping the trajectory of banking future. The trends signify greater than mere a technological progress; they represent a motion toward empowering customers with better access into transformative financial services, financial inclusion, and empowerment.

-

AI and Machine Learning Integration

AI and machine learning (ML) integration inside fintech applications represents a paradigm shift in how financial services are delivered and experienced by users. These technologies empower fintech apps to investigate large datasets with brilliant speed and precision, allowing them to offer personalized financial solutions tailored to individual needs and desires. By harnessing the potential of AI algorithms, fintech apps can automate routine processes, improve decision-making, and improve fraud detection and funding management. AI and ML integration scales overall customer experience and drives efficiency, accuracy, and innovation inside the financial technology space.

-

Blockchain and Cryptocurrency Adoption

Blockchain technology, characterized by its decentralized and immutable nature, is revolutionizing the fintech app development space through more security and transparency features. Fintech apps increasingly leverage blockchain to facilitate peer-to-peer transactions, smart contracts, and decentralized finance (DeFi) protocols. With its distributed ledger architecture, blockchain ensures tamper-evidence record-maintaining, reducing the threat of fraud and data manipulation. Moreover, adopting cryptocurrencies inside fintech apps offers customers cost-effective access to digital assets and transactions beyond boundaries. Smart contracts powered by blockchain automate settlement enforcement, eliminating the need for intermediaries and streamlining procedures.

-

Biometric Authentication for Better Security

Biometric authentication is revolutionizing safety in fintech apps by leveraging precise biological tendencies like fingerprints, facial functions, and voice patterns. This advanced generation provides multi-layered security in opposition to unauthorized admission to data access and theft. Fintech apps authenticate users with remarkable accuracy and reliability by analyzing biometric records, extensively improving security measures. Integrating biometric authentication involves state-of-the-art algorithms that extract and evaluate biometric records towards stored templates, ensuring excessive precision in identification verification. This strengthens safety and complements user satisfaction by imparting a frictionless authentication method, making it popular for robust financial transactions.

-

Voice-Enabled Banking and Virtual Assistants

Voice-enabled banking and virtual assistants constitute a groundbreaking development in fintech app development, revolutionizing how users engage with financial services. Fintech apps integrating voice technology allow customers to carry out banking tasks, check account balances, and make payments using natural language commands. AI-powered virtual assistants provide real-time financial insights and solutions to customer queries, automate routine banking tasks, and improve user experience and accessibility. These innovations leverage speech recognition algorithms to accurately interpret and respond to consumer commands, delivering a continuing and intuitive interface for engaging in banking transactions. Voice-enabled banking and digital assistants epitomize the blend of technology and finance, paving the way for a more quality, interconnected, consumer-centric banking experience.

-

Embedded Finance and Open Banking

Embedded finance and open banking catalyze a transformative shift in the banking landscape, minimizing the strains between traditional banking and other industries. Embedded finance involves integrating financial offerings seamlessly into non-monetary platforms and packages, increasing access to banking and payment functionalities. Open banking projects promote data sharing between banks and third-party developers through APIs, encouraging invention and competition within the financial ecosystem. Together, these trends allow organizations to embed financial offerings at once into their products, including imparting payment processing within e-commerce structures or having access to financial insights inside ride-sharing apps.

-

Personalized Robo-Advisory Services

Personalized robo-advisory services epitomize the intersection of technology and finance, revolutionizing investment management for customers of all backgrounds. These offerings leverage AI algorithms to analyze personal options, threat tolerance, and monetary desires, presenting tailored funding recommendations and portfolio management strategies. By automating investment approaches and rebalancing portfolios based on real-time market statistics, robo-advisors offer customers a cost-effective and accessible opportunity to traditional economic advisors. This personalized method not only optimizes the funding mechanism but also allows customers to make informed financial decisions aligned with their circumstances, driving extra financial literacy and wealth accumulation in the digital age.

-

Regulatory Compliance and Data Privacy

Regulatory compliance and data privacy are paramount inside the fintech enterprise, ensuring they accept the accuracy and security of customers’ financial data. Fintech apps enforce robust security features and adhere to stringent guidelines inclusive of GDPR and PSD2 to shield personal information from breaches and unauthorized rights of entry to data. Encryption techniques, everyday protection audits, and consumer-controlled privacy settings are fundamental additives of compliance techniques. Additionally, compliance management structures facilitate adherence to regulatory requirements, mitigating financial crime risks and safeguarding users’ privacy rights. By prioritizing regulatory compliance and information privacy, fintech apps uphold the best standards of integrity and confidentiality, encouraging agreement with and self-assurance amongst users.

Conclusion

The dynamism of the fintech industry is pushed with relentless invention, as evidenced by the aid of the developments highlighted in this exploration. From AI and blockchain to biometrics and embedded finance, top fintech app development trends are poised to redefine the boundaries of financial services. These advanced developments increase consumer experience in the smart banking ecosystem and drive empowerment on a global scale. Additionally, adopting new technologies and prioritizing customer-centric solutions will create a promising future where finance is more convenient, clear, and inclusive.