Artificial Intelligence (AI) has emerged as a transformative force in the financial technology (fintech) space, fundamentally changing how banking services are delivered to consumers. Integrating AI in fintech gives fantastic opportunities for innovation, overall performance, and user-centric solutions. With the functionality to process large quantities of data at better speeds, AI applications in fintech assist companies in scaling their operations across several dimensions: fraud detection, customized customer service, risk control, and compliance.

Staying at the leading edge in a competitive financial ecosystem requires more than traditional strategies. The adoption of advanced technologies allows fintech companies to automate complicated strategies, apprehend consumer behavior, and make precise, data-driven decisions. This improves operational performance and scales the user experience by offering personalized, well-timed, and relevant product suggestions and services.

This blog explores the technical intricacies of how AI can be leveraged to increase fintech platform performance, providing a comprehensive analysis of its applications and benefits in the industry.

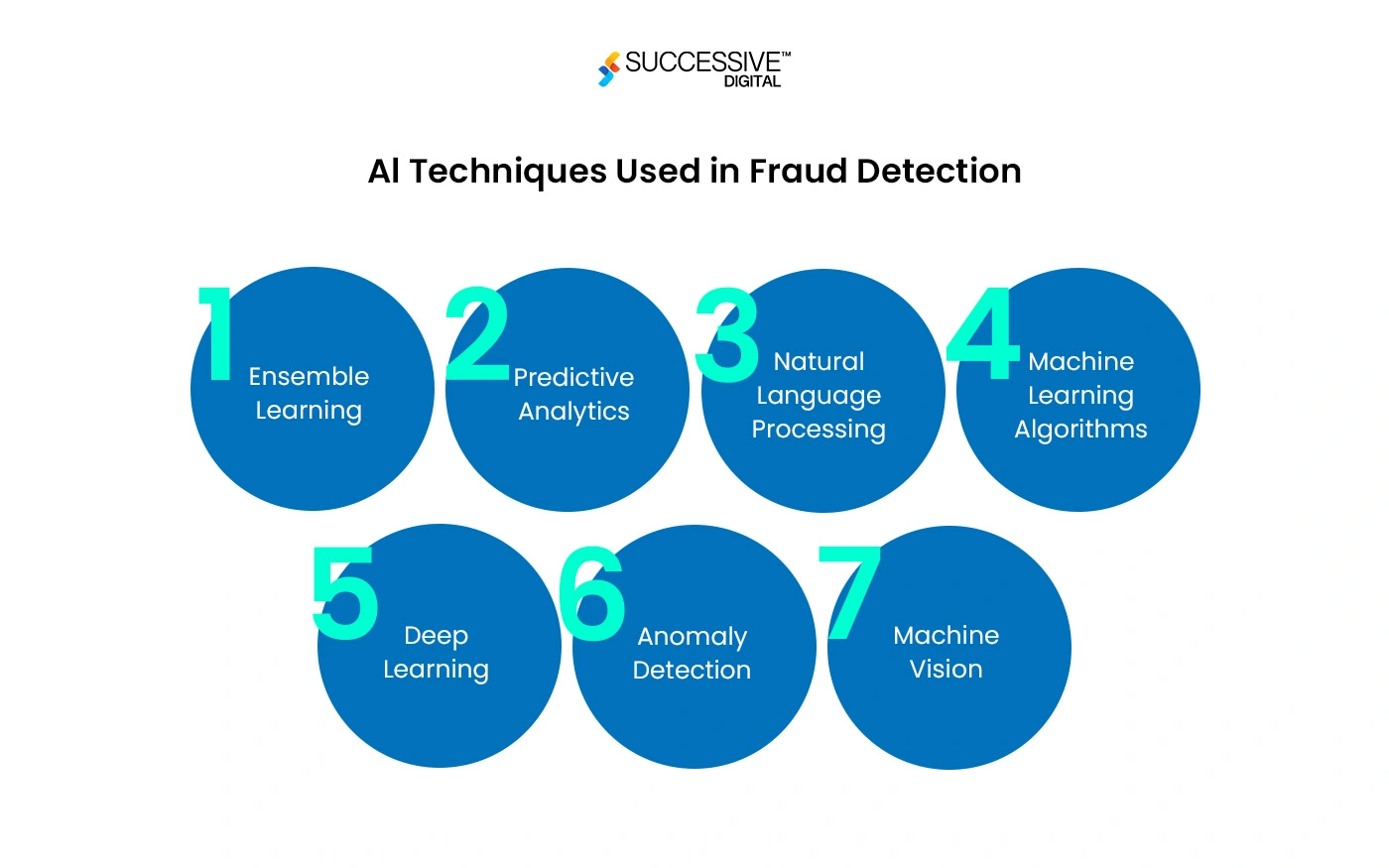

AI-Powered Fraud Detection and Prevention

-

Machine Learning Algorithms

Machine learning algorithms in fintech analyze enormous datasets to perceive patterns and expect results.

- Supervised Learning: Involves training models on labeled datasets where the outcomes (fraudulent or non-fraudulent) are known. Common algorithms include logistic regression, decision trees, and support vector machines (SVMs).

- Unsupervised Learning: Detects anomalies without prior labeling, using techniques like clustering (e.g., k-means, DBSCAN) and autoencoders to identify deviations from normal transaction behavior.

-

Real-time Analytics

Real-time analytics and AI in fintech leverage advanced intelligence methods and examine data as it is generated, allowing for immediate decision-making. Utilizing stream processing frameworks like Apache Kafka and Apache Flink, these structures detect and respond to anomalies, fraud, and market adjustments immediately, substantially improving operational responsiveness and safety.

-

Behavioural Biometrics

Behavioral biometrics in fintech employs AI to investigate specific user behaviors, such as typing patterns, mouse actions, and tool interactions. By creating individualized consumer profiles, these systems locate deviations that can imply fraudulent activities, improving safety through nonstop, nonintrusive authentication strategies that adapt to every user’s habitual interaction.

Personalized Customer Experience

-

Recommendation Engines

AI in fintech can improve purchasers’ experience by delivering personalized financial advice and product recommendations. Recommendation engines use collaborative and content material-primarily based filtering strategies to suggest monetary products (like loans, insurance, and investment opportunities) based on consumer choices and behavior.

- Collaborative Filtering: Analyzes patterns from multiple users to make recommendations based on similarities between users.

- Content-Based Filtering: Uses the properties of items and user profiles to make recommendations, independent of other users’ data.

-

Natural Language Processing (NLP)

NLP in fintech utilizes AI to understand and process human language, allowing advanced customer support via chatbots and digital assistants. Techniques like generative AI in fintech and sentiment analysis allow these structures to understand personal inquiries, offer accurate responses, and tailor interactions based on emotional tone, improving client engagement and satisfaction.

-

Predictive Analytics

Predictive analytics in fintech harnesses AI to investigate historical statistics and identify traits, allowing forecasts of future client behaviors and market actions. By applying strategies and ML models, these systems anticipate user desires, including loan requirements or funding opportunities, allowing for proactive and customized financial services.

Enhanced Risk Management

-

Credit Scoring

Traditional credit scoring strategies rely on confined datasets, regularly missing out on valuable insights. AI in fintech improves credit scoring models and include alternative data sources (which include social media, transaction records, and utility bills) to offer an extra complete assessment of a borrower’s creditworthiness.

- Gradient Boosting Machines (GBMs): Effective for creating robust credit scoring models by combining multiple weak learners to form a strong predictive model.

- Neural Networks: Particularly useful for handling complex, non-linear relationships in the data, offering superior performance in credit risk evaluation.

-

Stress Testing

Stress trying in fintech uses AI to simulate various economic eventualities, assessing the resilience of financial establishments under destructive conditions. Using techniques like Monte Carlo simulations and fintech machine learning models, these tests predict the impact of marketplace fluctuations, supporting financial institutions to prepare for challenges and maintain stability.

-

Portfolio Management

Portfolio management is a vital AI application in fintech that optimize funding techniques by analyzing sizable market information and predicting tendencies. Techniques like reinforcement mastering and genetic AI in fintech dynamically modify portfolios to maximize returns and minimize risks. This method ensures informed, data-powered decisions that adapt to market changes in real-time.

Automated Customer Service

-

Chatbots and Virtual Assistants

Chatbots virtual assistance uses NLP and generative AI in fintech to provide automatic, 24/7 customer support. These systems can handle routine inquiries, manner transactions and even assist with complicated financial decisions.

- Dialog Management: Maintains context during a conversation, ensuring coherent and relevant responses.

- Entity Recognition: Identifies and processes key information from user inputs, such as names, dates, and transaction details.

-

Robotic Process Automation (RPA)

RPA in FinTech uses AI to automate repetitive, rule-based tasks, including data entry, transaction processing, and compliance checks. Enhanced with fintech machine learning, RPA systems can manage more complicated workflows, improving accuracy and performance while liberating human resources for better high-value activities.

Compliance and Regulatory Adherence

-

Anti-Money Laundering (AML)

AI in fintech enhances AML processes by detecting suspicious transactions that may indicate money laundering activities. Techniques include:

- Pattern Recognition: Identifies unusual transaction patterns that deviate from normal behavior using clustering algorithms.

- Link Analysis: Maps relationships between entities to uncover hidden connections and networks involved in money laundering.

-

Automated Reporting

Automated reporting in fintech leverages AI to generate correct, real-time financial reports required by regulatory bodies. Using technologies like Natural Language Generation (NLG), these systems convert complex information into clean, human-readable formats, ensuring compliance, reducing manual effort, and allowing faster decision-making through timely insights.

-

Regulatory Technology (RegTech)

RedTech in fintech uses AI to streamline compliance approaches and ensure adherence to regulatory necessities. AI-driven RegTech solutions monitor real-time transactions, verify compliance risks, and generate indicators for violations. This enhances regulatory reporting accuracy, reduces compliance costs, and mitigates dangers related to non-compliance.

Conclusion

AI in Fintech platform offers numerous technical advantages, from improving protection and personalizing to optimizing threat management and regulatory compliance. By adopting advanced AI strategies into fintech app development processes, fintech providers can stay competitive, meet evolving user expectancies, and navigate the complexities of the financial ecosystem with more agility and precision. As AI applications in finance evolve, their role in fintech will expand, paving the way for more remarkable, revolutionary, and efficient financial solutions.