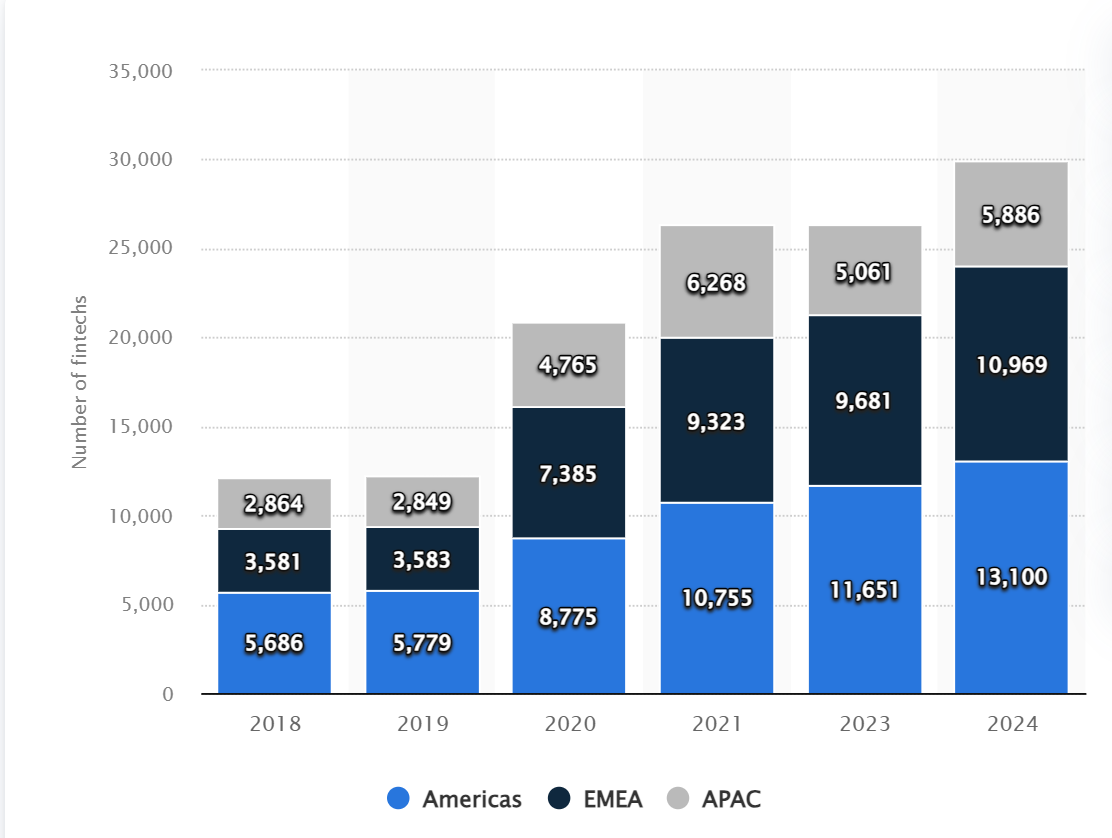

Technology-driven and innovative startups are rapidly taking over traditional financial institutions, making FinTech a promising niche worth exploring. The rapid advancement in technology is rising the industry’s unprecedented growth rate, transforming it into a sector worth billions of dollars.

Consequently, there has been a remarkable rise in the FinTech user base, startups, and revenue. The global fintech industry’s revenue is increasing quickly, estimated to exceed 141.18 billion U.S. dollars in 2028. Meanwhile, the number of digital payment users is expected to witness an increase of 4.81 billion in 2028. The industry’s growth indicates a substantial increase in FinTech applications and highlights its potential to evolve into a revenue-driven enterprise.

Image Source: Statista

Intelligent technologies like artificial intelligence, blockchain, cloud, and big data revolutionize the banking and finance sector, turning it into a transformative force in the global financial landscape. Due to the rapid advancement of technology, the potential for further disruption in the FinTech sector is extensive.

Hence, if you are considering expanding your business in this sector, this is the right time to know the total FinTech app development cost and the factors influencing this estimation.

Factors Influencing FinTech App Development Cost

What is the cost of developing a FinTech app? Delivering a precise estimate for the development cost of a FinTech app is intricated due to the diverse range of factors at play.

This section will guide you through the complexities of developing a FinTech app that affects its development cost.

Feature Complexity

The features you integrate into your FinTech application will create a unique app experience and significantly impact costs. The design intricacies, functionality, and user interface are highly dependent on the basic to advanced feature complexity.A simple digital payment app development cost with basic features like making transactions and checking account balances is significantly lower than the cost of developing a banking app with advanced features, such as AI-driven data analytics and real-time tracking. Here are some of the features your FinTech app must have in order to elevate the app’s functionality Read our complete FinTech app development guide to learn more about the standard, advanced, and must-have features in detail.

Read our complete FinTech app development guide to learn more about the standard, advanced, and must-have features in detail.

Security Measures

The security measures you implement into your FinTech will also impact the development cost. For instance, an app with basic security features and compliances with encryption and authentication will be less costly compared to an app that follows advanced security parameters like multi-factor authentication (MFA), secure coding, and application security testing. Furthermore, advanced data encryption and privacy measures will increase the FinTech app development cost.

UI/UX Design

With custom FinTech app design, you can ensure a personalized and streamlined user experience. Therefore, an intuitive and user-friendly interface with a clearly defined user journey is essential for enhanced app usability. The unique design elements like animations, transitions, and app layout will contribute to FinTech application development costs.

Regulatory Compliance

In the FinTech sector, effective management and protection of extensive datasets are essential. Additionally, establishing clear rules and regulations regarding data access and usage limits is crucial. Therefore, ensuring proper compliance and policies becomes a significant factor when determining the cost of developing FinTech applications. FinTech applications must comply with various regulations and policies, like:

-

- Know Your Customer (KYC)

- Anti Money Laundering (AML)

- Payment Card Industry Data Security Standard (PCI DSS)

- Digital signature certificates

- General Data Protection Regulation (EU GDPR)

- Industry-specific and region-oriented regulations

Testing and Maintenance Cost:

Since custom fintech app development is a continuous process, you must consider and define testing and maintenance costs during the initial requirement gathering and project scope phase. After the app development, an app’s features and functionalities must be regularly updated to scale the business. Also, app maintenance should be your top priority, adding to the overall cost of the application. Our blog on mobile app development costs will give you an idea of the seamless process of building a FinTech app, along with the budget needed to test and maintain it.

Development Team Type

When it comes to developing your digital finance application, accessing FinTech app development services offers several options. The approach you take in hiring and setting up a team of app developers for your project will directly impact the cost of FinTech app development. However, each method has its own advantages and disadvantages that you must understand in order to make the right decision for your business.For instance, having an in-house team is beneficial in terms of familiarity with the ecosystem and better control over the project. But, it will be a costly process due to additional charges you need to maintain, such as salary, taxes, recruitment, creating a workspace, covering medical licenses, etc. Conversely, freelancers can present a more cost-effective option, but they may offer less consistency and may not be as committed to your project over the long term. Meanwhile, outsourcing to a FinTech app development company provides a balanced middle-ground between the risks associated with freelancers and maintaining an in-house team. They provide high-quality solutions tailored to your specific idea, regardless of its size or complexity. Additionally, you gain access to a vast talent pool equipped to fulfill your app development needs with their expertise in the field.

| Type of App Development Team | Average Cost of FinTech App Development |

| In-house | $120,000+ |

| Outsourcing app development agency | $90,000+ |

| Freelancers | $20,000+ |

Note: The average FinTech application development costs provided above are for comparison purposes among different types of teams, based on a 1,000-hour development timeframe.

FinTech App Development Cost As Per Development Team Location

Geographical location significantly impacts the pricing of FinTech app development services, with costs varying depending on the region. The expenses associated with building digital finance apps in certain areas are higher compared to others.

This pricing is typically determined by the hourly rates of hiring professionals for your development team. A standard app development team comprises 4-12 professionals, depending on the project’s scale.

Now, let’s delve into a cost comparison of various FinTech apps based on location:

| Development Team Location | Cost of Hiring FinTech App Development Company |

| Central Europe | $160,000+ |

| Western Europe | $240,000+ |

| Asia | $120,000+ |

| North America | $350,000+ |

| Oceana | $200,000+ |

Different Types of FinTech Apps and Their Estimated Cost

Five main markets constitutes FinTech: digital payments, digital investments, digital capital raising, digital assets, and neobanking. Additionally, there are other types of finance-related digital applications counted under FinTech. Each of these markets encompasses various types of digital solutions.

The following estimates are based on an hourly rate of $50, which is a standard price for hiring experienced app developers from reputable FinTech app development service providers.

| FinTech App Categories | Estimated Development Time (Hours) | Average FinTech App Development Cost |

| Digital Wallet App | 3000 | $1,50,000 |

| Banking Apps | 2850 | $1,42,500 |

| Lending Apps | 2300 | $1,15,000 |

| Personal Finance Apps | 2600 | $1,30,000 |

| Insurance Apps | 2850 | $1,42,500 |

| Investment Apps | 2300 | $1,15,000 |

| Billing and Payment Apps | 2300 | $1,15,000 |

| Crowdfunding Platform | 2800 | $1,40,000 |

Note: This is an average estimated cost, which can vary based on your specific project requirements, complexities, features, and various other factors.

How to Reduce FinTech App Development Cost? Budgeting Success Tips and Solutions

The cost of creating a FinTech app hinges on various factors and the process itself. By implementing a well-aligned and effectively managed procedure, you can mitigate the challenges in development and potentially reduce the overall FinTech app development cost.

Prioritize App Features

When initiating the FinTech app development process, prioritize identifying the essential features and omitting the rest. Simplifying feature complexity can decrease app development costs, as it reduces the efforts and time needed to build those features.Additionally, you can integrate advanced features into your application at a later stage to scale your business, thereby managing the cost of developing a banking app more effectively.

Choose the Right Platform

The platform you select for deploying your application will also impact the cost of FinTech app development. Choosing the right platform and application development methodology is crucial for ensuring cost-efficient app development. For instance, developing FinTech applications separately for iOS and Android platforms using native technologies will incur higher costs compared to utilizing cross-platform frameworks like Flutter or React Native.

Consider MVP Development

Developing a Minimum Viable Product (MVP) is not only an effective strategy for testing and validating your app idea in the market and gathering valuable user feedback, but it can also lead to significant savings in development costs. Launching your app with an MVP approach allows you to assess its performance and market feasibility, enabling you to refine your app’s functionality based on real-world data and user insights.

Choose the Right Development Partner

Outsourcing your project to a reputable FinTech app development company provides you with the opportunity to collaborate with skilled professionals in the field. These companies boast teams of seasoned app developers who will handle your project efficiently at a competitive cost. Additionally, your project will benefit from structured management and transparent communication throughout its lifecycle. With a wide array of options available, you have the flexibility to select a company that aligns with your budgetary requirements.

Empowering Your FinTech Journey with Successive Digital: Your Trusted Development Partner

Fintech application development is continuously evolving, and new advancements are becoming the focus of this industry sector. Therefore, finding a position among the many worldwide businesses ranging from startups to tech enterprises to well-established companies is challenging. Hence, Financial institutions collaborate with tech firms to gain access to the new market and broaden their clientele and offerings.

As the fintech business is experiencing fast growth in its technological side, Successive Digital is at the forefront of this innovation, specializing in building custom fintech applications with enhanced accuracy, efficiency, and agility. Our custom FinTech app development services make digital finance solutions to become more customer-focused.

Conclusion

In recent years, we have witnessed the emergence of various fintech subcategories, including insurtech, regtech, payment services, and more. Hence, fintech is more than just a passing trend. These subtypes leverage intelligent technologies tailored to business objectives and demands, such as blockchain, AI, cloud computing robotics, and data analytics.

The integration of futuristic technologies is a key factor in determining the cost of developing a high-performing financial app. Additionally, factors such as the type of FinTech app, UI/UX design, features, and developer charges all contribute to the overall cost of building a FinTech app.

Taking these factors into account, the FinTech app development cost with low complexity falls between $60,000 and $90,000. For projects with moderate complexity, the cost can range from $90,000 to $150,000. However, when advanced technology and feature integration are involved, the complexity of the app increases, resulting in the finance and banking app development cost exceeding $300,000.

FAQs

The cost of developing a fintech app with a seamless payment system depends on its complexity level and the number of features. A simple app with low complexity can cost around $80,000. This cost can rise depending on the increased complexity level and reach up to $250,000 (or more, depending on the additional features).

Depending on the number of features, technologies, and platform choices, banking app development costs can range between $50,000 to $150,000. However, with the integration of more features, API, and advanced technologies, this cost can rise to $300,000.

A standard Minimum Viable Product (MVP) version of a mobile banking app typically requires 3 to 6 months to develop. As additional features are incorporated, the development time can extend to approximately 9 to 11 months. However, the development of a full-fledged mobile banking app may take more than 1 year to complete, with ongoing maintenance considerations also factored in.