Financial services and transactions have moved to digital means long ago, but mobile-based payments and transactions are now mainstream. According to a survey, the number of smartphone users worldwide in 2023 is 6.92 billion, which translates to 86.29% of the world’s population owning a smartphone.

Given the growing adoption of smartphones and many supporting financial applications, people are becoming more technology savvy in communication and financial transactions, also known as FinTech applications.

These FinTech applications (powering banking and financial services with technologies) have provided financial institutions with an alternative means for building meaningful customer relationships by simplifying financial services with digital technologies.

Though many FinTech applications are already available in the market, we can still see new applications entering the market and building a space for themselves. This has been done as many things in banking and financial services are still untapped.

If you also have a FinTech application idea that can solve a problem of traditional banking and financial solutions, you can begin with the application development through MVP to test and validate your FinTech application with your target audience’s needs. An application idea could open up a new revenue opportunity for you if it solves consumers’ problems of dealing with their finances.

If you are unsure how to begin FinTech application development, what it needs to develop an application, what to consider before developing a FinTech application, and how much it costs, continue reading since we will answer all such questions in detail in the blog.

Let’s begin!

Table Of Content

- What Is A FinTech App?

- What Is FinTech App Development?

- Types Of FinTech Apps

- Reasons To Develop A FinTech Application

- Must-Have Features Of A FinTech Application

- General Features Of Fintech Apps

- Advanced Features Of Fintech Apps

- What To Consider Before Developing A FinTech App?

- Top FinTech App Development Trends In 2024

- How FinTech Applications Make Money?

- TechStack Used To Develop FinTech Apps

- Step By Step Guide On How To Create A FinTech App

- How Much Does It Cost To Build A FinTech App?

- How Successive Digital Can Help In Developing A Winning FinTech Application?

What Is A FinTech App?

FinTech stands for financial technology, which provides financial services through web and mobile applications. It addresses businesses and customers and offers them a more convenient and accessible way to manage their finances. These applications can be accessed through smartphones, tablets, or other mobile devices. You can check real-time account balances and transactional history and can get financial insights.

Since financial services are of varying types, the FinTech application could support online banking, investment management, digital payments, budgeting tools, and others. These types of financial applications are becoming increasingly popular since these apps remove the need to carry along debit or credit cards or passbooks, and money or financial information can be accessed through mobile applications in real time without visiting the physical offices of the respective financial entities. Financial services rendered over application are accessible at lower fees than traditional methods and save time by all means for users.

What Is FinTech App Development?

FinTech application development uses software development best practices, methods, and technologies to develop financial applications for mobile and web platforms. It also incorporates user experience design and financial expertise to create intuitive, functional, and user-friendly applications that resonate with users’ financial requirements. The financial application development process often revolves around the following methods:

- The objective of developing the application or problems the application solves.

- Designing the user interface or designing the application’s features and providing it with focused functionalities.

- Developing backend infrastructure or developing and implementing business logic separates the application from existing FinTech applications.

- Testing the application technically and with real users to check the functionality, security, and user acceptance.

Advanced and innovative technologies are often picked for developing FinTech applications, including blockchain, machine learning, artificial intelligence, cloud computing, and others. Together, such technology stacks ensure privacy, security, high performance, and efficient financial services implementation and transactions.

Types Of FinTech Apps

Finance is a highly prolific industry. With the advent and integration of financial technologies, it addresses all aspects of financial needs a user or business experiences in their day-to-day life. Henceforth, you can find FinTech applications fall into several categories and types. Let’s discuss them and understand their significance in today’s time.

1. Insurance Application

Insurance is one of the imperative financial services. Recent years have seen significant insurance workflow automation to speed up the claim processes, policy administration, and reduction in fraudulent activities.

Insurance applications often include the following components: payment processing, quotes, claim filing, and searching policies per the company’s rule of business logic. Some of the top insurance applications that you can consider for getting inspiration are Geico Mobile and Lemonade.

2. Investment Application

Investment applications are financial applications that provide convenience to users to access all the details related to their investments digitally and in real-time. These applications particularly refer to financial services such as stock trading, mutual funds, cryptocurrency, etc.

As a FinTech solution, an investment application allows users to research assets online and invest in them promptly. Developing a winning insurance application requires you to build and provide core features such as savings, multi-currency, credit management, comparison of assets, real-time notifications, customer support, etc. To get inspiration for developing an insurance mobile application, you can take the examples of Robinhood and Wealthbase.

3. Banking & Money Management Application

Banking applications are the applications that put banking services and solutions into the hands of users. You may already be familiar with this process or may already be a user of a banking application. But it doesn’t end up business opportunities in the realm as not all banking services and solutions are provided online due to security or other reasons.

If you have an application idea that solves one of the banking challenges, you should explore FinTech app development services. One of the best examples of banking and money management mobile applications available in the market are PayPal, Starling, and others.

4. RegTech Application

RegTech stands for regulatory technology that helps spin-off FinTech solutions. As it leverages machine learning, AI, and other advanced technologies, it automates data governance, monitors regulatory changes, reduces false non-compliance alerts, manages compliance, and simplifies reporting processes to eliminate manual and error-prone regulatory management processes.

However, you must consider adding identity, risk management, and financial crime identification processes while developing a RegTech application. RegTech applications such as 6 Clicks and Passport are good examples representing advancement in the regulatory process by automating KYC processes and other financial services enablement requirements.

5. Money Lending Application

Money lending application development is one of the growing verticals in the FinTech world. Operating money lending processes through an application eliminates the involvement of intermediaries such as loan brokers, banks, or other financial institutions.

Another advantage of a money lending application is that it offers loans at less interest rate since it avoids intermediaries’ involvement and directly passes the benefits to the customer. Some of the top application features you can build and provide within your money lending application through FinTech mobile app development process comprises credit score, loan application form, billing, payment, and others. For inspiration, you can check Earnin and PaySense.

6. Consumer Finance Applications

Not every FinTech application is meant for banking solutions. Since technology has simplified other aspects of life, FinTech application development services can be leveraged for developing budgeting and personal finance management applications. These types of applications are known as consumer finance applications allowing users to manage personal finance and enable them to make better financial decisions.

These applications take advantage of advancing AI and ML solutions to provide personalized experiences for a range of financial goals, such as expense and bill tracking, investments analysis, fraud alerts, forecast future expenses, and others. It enables users to keep checking their spending habits and not overdue expenses than required. One of the best examples available in this category includes Mint and Money Patrol.

7. Accounting Application

Accounting is one of the top financial services. You can leverage FinTech application development services to build an accounting solution that easily addresses users and businesses in managing their account books. Some of the top application features you can ensure within the application include invoicing, expense tracking, bank reconciliation, receipt management, tax preparation, and others.

It helps simplify daily life, reduce the risk of errors, and save them from events when they forget to note down expenses and later struggle to match the balance sheet. QuickBooks and Xero are a few of the most popular FinTech accounting applications available in the market you can get inspiration from.

Also read – Digital Wallet App Development Guide

Reasons To Develop A FinTech Application

If there ever was a time to engage in finance mobile app development, that time is now. There are compelling reasons to build mobile applications focusing on FinTech services. Before we jump on to the next section and understand how to build FinTech applications, let’s understand the benefits of developing FinTech applications.

1. Broader Market Reach And Presence

Since FinTech services are rendered online, you can tap into other large markets for smartphone users. Mobile applications have become a preferred way among users to connect with businesses, banks, and financial institutions. FinTech applications provide the same convenience over smartphones and allow users to perform financial transactions on the move without any difficulty digitally. This way, businesses can increase their market reach and untap new revenue opportunities.

2. Superior Customer Experience

A FinTech application saves users from standing in long queues at financial institutions regarding any particular query. They get the whole world of financial solutions on their hands, such as making payments, transferring funds, checking account balances, and many other functions. This leads to excellent customer experience and contributes to the company’s success.

3. Increase In Engagement And Sales Opportunities

Mobile apps bridge the gap between businesses and users and offer a more engaging experience than browsing websites. Investing in FinTech app design can increase customer engagement and unlock new sales opportunities. Companies strive to have their own apps to bring their users closer to their business. To achieve this, collaborating with a top mobile app development company can give you an edge over your competition and deliver a FinTech app of the highest caliber.

4. Far Better Security

Website payments often face security risks, but the good news is that FinTech mobile apps are shielded by multiple layers of security protocols, ensuring that they are not vulnerable to such risks. FinTech app development provides customers and enterprises with enhanced security features. The latest encryption technology protects these apps, resulting in a faster, safer, and more secure experience than traditional banking apps.

5. Data Management

Developing a FinTech application can provide superior data management solutions, significantly enhancing your business productivity and customer experience. In today’s world, data is one of the most valuable assets, and FinTech apps can effectively manage it by consolidating it on a single platform. This will not only reduce your operational costs but also boost your productivity.

6. Better Financial Inclusion

Although many customers are not utilizing mobile banking, the FinTech revolution is altering the landscape by encouraging financial inclusion for almost anyone with a smartphone. Financial inclusion is critical since it enables individuals to save money and connect with banking services. FinTech apps can also function as loan platforms, competing with traditional bank loan services. Several FinTech startups are currently pursuing this model to provide users with easy credit and tap into the market.

7. Lightning Speed

FinTech apps leverage digital technology to provide lightning-fast loan approvals and transaction speeds. Developing FinTech apps can significantly simplify fund transfers and loan reviews. Unlike traditional banks, which can take days to process simple transactions, FinTech apps offer speedy loan approvals and fund transfers.

8. User-Friendly Applications

Many users often perceive traditional banking apps as complex and unexciting, despite significant improvements in recent years. In contrast, FinTech apps provide a user-friendly and intuitive experience. With the assistance of top FinTech app developers, you can create a user-friendly interface that includes straightforward menus, dashboards, and color schemes. Building a FinTech app entails comprehending user requirements and streamlining the process.

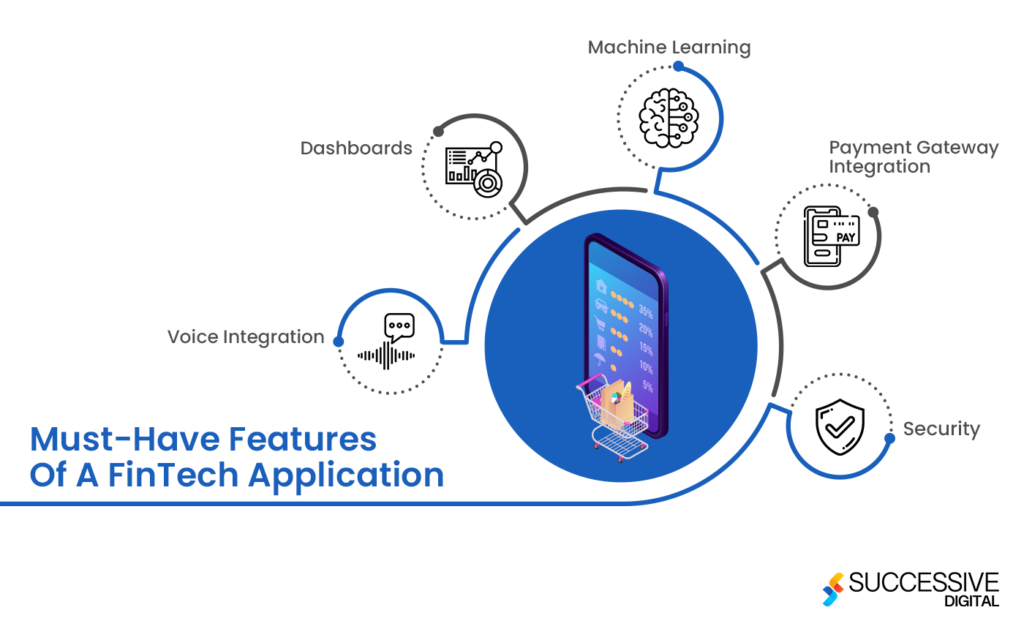

Must-Have Features Of A FinTech Application

Since a FinTech application is yet another smartphone application, it requires you to implement all the features within it so that it meets the parameters essential for its wide acceptance among users. The must-have features that you should ensure before releasing

your FinTech application includes the following:

1. Security

The finance industry is a highly regulated one all across the world. Since your application will store people’s financial information, it is important that you take all security measures in concern to secure your application. You can ask your FinTech developer to use advanced security practices and implement technologies such as blockchain, biometrics, encryption, two-factor authentication, data obfuscation, and others. Enabling strong security help build confidence in your target users to use your FinTech application since it will keep their details personal and confidential.

2. Payment Gateway Integration

Most FinTech applications revolved around online payment or payment integration solutions. You can also enable the payment functionality within your FinTech application since it will provide them a one-stop solution to manage their saving and spending altogether. One of the best payment gateway integrations your FinTech developer can choose include PayPal, Stripe, and others.

3. Machine Learning

AI and ML have matured significantly in the past few years and are contributing to the innovation of FinTech applications. You can use the advanced algorithms and models of ML for your application that will take data from various inputs, analyze it, and provide personalized advice to every user based on their activities and habits related to their financial management.

4. Dashboards

You must simplify finance management through your FinTech application. One of the best ways to enable it within your application is to provide users with an intuitive dashboard. A dashboard with visual representations of users’ spending, payment history, or stock charts helps them understand their habits and streamline their thoughts for further decisions.

5. Voice Integration

Voice integration is one of the most interesting features you can introduce to your FinTech application. With Alexa, chatbots, and voice assistants, people are keen on voice assistant services. Enabling voice assistants within your application allows them to interact with the application without opening it.

General Features Of Fintech Apps

- Registration: A user-friendly registration feature simplifies users’ account creation process. It ensures compliance and security for your FinTech app.

- Personal Account: Through the FinTech app, you can empower users to manage their finances, track transactions, and access financial services through essential personal account features.

- Payment Gateway: Providing a payment gateway solution within your FinTech app allows users to transfer funds between accounts with ease and security.

- Financial Management: Having a feature like financial management gives users complete control of their finances and enables them to achieve their goals.

- Connecting or Creating Bank Cards: Allow users to connect their debit/credit cards to your FinTech app by providing them with a feature that supports the activity. It gives them access to account information in one place.

- Notification: Enabling a feature like notification keeps users informed in real-time instantly for all financial transactions and account activities.

- History of Transactions and Interactions: This feature allows users to gain insight into their financial history and bring complete transparency.

- Onboarding System: Quickly and efficiently onboard enablement allows new users an intuitive onboarding experience on your FinTech application.

- Chatbots: Integrating chatbot as your customer support tool help you reduce costs and enhance user experience. It will help you maintain better engagement and enable you with a better understanding of customer needs.

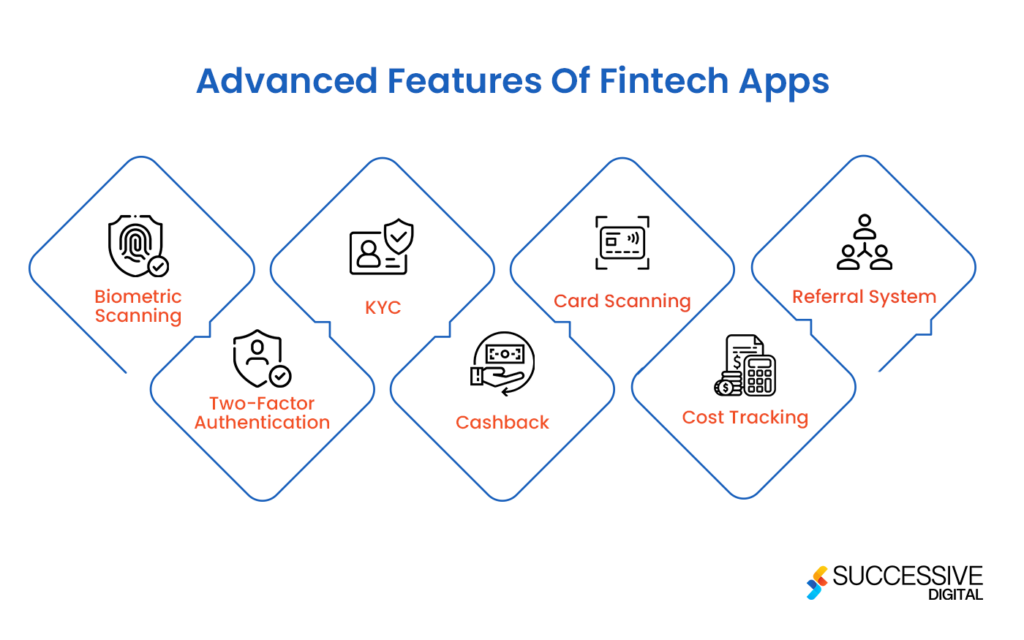

Advanced Features Of Fintech Apps

- Biometric Scanning: Ensure top-notch security and user experience with biometric scanning features, preventing fraud, ensuring compliance, and providing valuable data for analysis.

- Two-Factor Authentication: Offer users a choice of authentication methods with versatile two-factor authentication features for enhanced security.

- KYC: Better understand your customers’ needs and preferences with KYC feature, allowing you to offer personalized services and products.

- Cashback: Increase customer loyalty and encourage app usage with a cashback feature, giving customers a reward for using the app for financial transactions.

- Card Scanning: Simplify payment card management with a card scanning feature, allowing customers to add payment cards to their accounts quickly.

- Cost Tracking: Enable customers to make more informed financial decisions with a cost tracking feature, providing personalized recommendations based on their spending patterns.

- Referral System: Foster a sense of community among users and encourage app usage with referral system features, increasing customer engagement and retention.

What To Consider Before Developing A FinTech App?

Before embarking on the development of a FinTech app, it is important to consider the essential features that will ensure the success of your startup. The FinTech ecosystem is complex, and its features, such as security, integrations, simplicity, and support, should be considered early in the process to avoid further roadblocks and delays in product shipment.

1. Security

Security is of utmost importance in the FinTech industry, as any security breach can lead to the loss of customers. Incorporating features such as 2-factor authentication, fingerprint or face scan security, log-in through OTP, and dynamic CVV2 codes can enhance security in your FinTech app. Penetration testing should also be conducted to identify vulnerabilities and prevent hackers from exploiting them. Moreover, regulatory compliance with laws such as PCI-DSS, PSD2, FCA, CCPA, GDPR, or PIA is essential and should be implemented in the initial development phase.

2. Integrations

Integrations are crucial in FinTech app development, and APIs are the foundation for building such apps. APIs can link different apps or portals and can issue commands to third-party service workers. They are also cost-friendly and can be integrated with payment methods such as PayPal, Braintree, Stripe, etc., to enable users to shop anywhere.

3. Simplicity

To attract and retain customers, simplicity is key. A user-friendly design that simplifies the user experience and makes analytical tools easy to use can go a long way in ensuring the success of a FinTech app.

4. Support

FinTech apps must have a reliable support system in place. Highly confidential data is involved, and customer queries must be handled by a trained technical team that operates under strict safety rules and requirements. If hiring a team is not possible, creating a chatbot that can assist customers 24/7 is a viable alternative.

Top FinTech App Development Trends In 2024

The following are the top FinTech app development trends that are expected to shape the industry in 2024:

- Integration With Blockchain Technology: More FinTech apps are expected to integrate blockchain technology to improve security and transparency.

- Personalization And AI-Driven Features: AI-driven features like chatbots and virtual assistants are expected to provide more personalized financial advice.

- Expansion Of Open Banking: Open banking APIs will continue to be used by FinTech apps to provide more value-added services.

- Increased Use Of Biometrics: Biometric authentication methods like facial recognition and fingerprint scanning will become more common in FinTech apps, providing improved security and convenience for users.

- Growth Of Decentralized Finance (DeFi): More FinTech apps are expected to embrace DeFi, which aims to provide financial services without intermediaries.

- Focus On Sustainability: More FinTech apps are expected to incorporate sustainability into their business models and services.

- Expansion Of Neo-Banks: Digital-only banks or neo-banks are expected to continue to grow in popularity, providing customers with more convenient and accessible banking services.

By following these trends, FinTech app developers can stay ahead of the curve and provide innovative solutions that meet the evolving needs of users in 2024.

How FinTech Applications Make Money?

FinTech apps can use different monetization strategies depending on their target audience and type. Below are some of the most common strategies employed by FinTech apps:

- Subscription Model – Users pay a monthly or yearly fee to access premium features or services of the app.

- Freemium Model – FinTech apps provide a free version of their app with some limited features, and users can upgrade to the paid version to access additional features or services.

- Transaction Fees – FinTech apps earn revenue by charging transaction fees for payment processing, foreign exchange, or investment management services.

- Advertising – FinTech apps can generate revenue by displaying targeted advertisements to users based on their financial activity and preferences.

- Referral Programs – Some FinTech apps reward users who refer friends or family members to the app.

- Data Monetization – FinTech apps can monetize user data by selling insights or analytics to third-party companies.

By using these monetization strategies, FinTech app developers can generate revenue and sustain their business models while providing users with valuable services.

TechStack Used To Develop FinTech Apps

FinTech apps have risen recently, providing innovative financial transaction and management solutions. Behind the scenes, these apps rely on a specific technology stack, or set of tools and programming languages, to deliver their services efficiently and effectively. Explore the various tech stacks FinTech app developers use to create robust and user-friendly applications.

| Category | Tech Stack For Android FinTech Apps | Tech Stack For iOS FinTech Apps |

| Programming languages | Java or Kotlin | Swift or Objective-C |

| Integrated Development Environment (IDE) | Android Studio or Eclipse | Xcode |

| Databases | MySQL, PostgreSQL, MongoDB, or Cassandra | MySQL, PostgreSQL, MongoDB, or Cassandra |

| Cloud platforms | Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform | Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform |

| Payment gateways | PayPal, Stripe, or Braintree | PayPal, Stripe, or Braintree |

Step By Step Guide On How To Create A FinTech App

If the thoughts stick with you about how to create a FinTech app, no worries since we will demonstrate the crucial steps below. Developing a FinTech application requires intense financial and technical expertise. If you already have industry knowledge or have people with business acumen, all you need is the help of an experienced Fintech app development company having experience in developing FinTech applications. To avoid further roadblocks in developing a FinTech application and stay on track, you must define all stages of app development essential for a FinTech application. Let’s check them.

- Select a FinTech niche

- Be in alignment with compliance

- Decide application features

- Set up a team

- Initiate application prototype

- Develop an MVP

- Put it to a quality test

Let’s understand each stage in detail.

1. Select A FinTech Niche

As mentioned above, a FinTech application could be dedicated to different finance services. Henceforth, it is important that you decide which niche you want to address with your FinTech application. Once you decide on your FinTech niche, analyze your target audience and market scope.

It will help you decide whether to develop a FinTech solution from scratch or upgrade an existing FinTech solution, like UI/UX improvements. Adding functionality would do wonders for your users. All you need to do is to be unique, value-added, and innovative through your mobile application. After deciding on the niche, you must legalize your application.

2. Be In Alignment With Compliance

We have already discussed FinTech as a highly regulated industry. Therefore, you must consider compliance and regulation guidelines from the beginning of application development. Check through the implementation and integration of KYC, AML, and other financial protection systems essential to track compliance. Also, consider CCPA, GDPR, PIA, LGPD, and other privacy laws to ensure the user’s financial data is protected on your application or has limited access.

And top of it, you must thoroughly check and gain knowledge of the privacy laws of your target audience’s region. For example, the USA doesn’t have a FinTech regulator but must comply with many state and federal laws. In such scenarios, you should be careful with legal requirements as any breach of your system and information leak will put you liable for questioning, or it could result in a heavy fine too.

3. Features Consideration

The features of your FinTech application will be decided upon by the niche you choose to build your application. Based on that, you can decide the features your target audience will require to complete a task on your application. However, there are some basic features and functionalities that every FinTech application often requires. You can consider them to begin your FinTech app development. As your application grows, you can scale the features and functionalities that resonate with your target audience and provide them better experience on your application. Here are some of the common features you can include within your FinTech application.

- Highly Secure Login: Fingerprint, facial, or voice recognition

- Push Notifications

- Tracking of budgets and savings

- Financial operations include transferring money, digital payments, checking balances, etc.

- Card Number and QR code scanning

- A virtual assistant or an AI-powered Chatbot

- Unconventional financial services like buying gift cards, donations, etc.

- Cashback, Offers, and Deals

4. Make A Development Team

The next and highly crucial thing you need to do for finance mobile app development is to find the right people or vendors and set up your technical team. Outsourcing software development services is convenient as it saves time and money; you get the best resources available within no time and scale up and down as and when required. Setting up a development team will help you get answers to all your development queries backed by technical solutions.

You can decide the team size, milestones, and deliverables based on your project requirements. Whether you would like to initiate the development with cross-platform tools like Flutter or React Native or thinking of beginning with native mobile application development, you can interview and hire the resource as long as you require.

A cross-platform FinTech app development team often comprises of these:

- 2 Developers (Frontend and Backend)

- Business Analyst

- Project Manager

- Designer

- QA Specialist

- DevOps Engineer

Whereas the native FinTech app development team comprises of these:

- 2 Developers (Android and iOS)

- Business Analyst

- Project Manager

- Designer

- QA Specialist

- DevOps Engineer

You can check the vendor’s overall experience in software development and delivery and the developer’s relevant experience with technologies and industry domains.

5. Designing Of The FinTech App

You may get application downloads soaring up through marketing and advertising efforts. Still, users only stay on the application if it provides intuitive and easy navigation through the promised FinTech solutions.

Henceforth, the UI/UX and overall design, including the color scheme, play a crucial role in attracting and retaining users on a mobile application. With the help of an experienced designer, you must take good care of the design of your application and ensure that it offers a smooth usability experience.

6. Develop An MVP

Consider building a Minimum Viable Product (MVP) to determine if your idea has market potential. An MVP includes basic features of your app and is developed with minimal costs, which can help save money. If the MVP performs well in the market, consider adding advanced features to it.

7. Quality Analysis

After launching your app, it’s important to continue evaluating its quality. Conducting an A/B testing phase can help you collect user feedback, which can then be used to enhance existing features and develop new ones. Ensuring that your FinTech app runs smoothly, securely, and is user-friendly can help you stay ahead of your competitors.

How Much Does It Cost To Build A FinTech App?

The FinTech app development cost depends on various factors such as complexity, required features, development platform, and team location. While basic apps cost less, those with advanced features can cost much more, ranging from $50,000 to $500,000 or more. Other factors, like maintenance and support, marketing, and updates, should also be considered since you must maintain and update your application as technology evolves and the user’s needs grow. It’s advisable to consult with experienced mobile app development companies to get a detailed project proposal that includes scope, timeline, and costs to obtain an accurate cost estimate.

Also read – How Much Does it Cost to Make an App?

How Successive Digital Can Help In Developing A Winning FinTech Application?

Developing a FinTech app in 2024 requires a thorough understanding of the latest trends, best practices, and technologies. Successive Digital has the expertise in optimally using advanced technologies in alignment with business acumen. We have earned the knowledge and developed the skill while working on client projects right, from developing payment-integrated solutions to money lending applications, digital wallets to FinTech CRM, and others. Having hands-on experience in FinTech mobile app development lets us consult you with the right development team, technology stack, and complete support for full-cycle application development.

FAQ - FinTech App Development

A fintech mobile app is a mobile application developed to render financial services and solutions over technology and with technology. These applications enable users to manage their finances, make payments, invest, access banking services, and more conveniently from their mobile devices.

There are various types of fintech apps, including payment and money transfer apps, digital wallet apps, personal finance management apps, investment and trading apps, digital banking and neobanking apps, peer-to-peer lending and crowdfunding apps, insurance and risk management apps, and budgeting and expense tracking apps.

A fintech app typically integrates with various financial systems and APIs to facilitate seamless transactions and provide users with financial services. It securely handles user data, implements authentication and encryption protocols, and offers a user-friendly interface for users to perform financial tasks such as transferring funds, making payments, managing investments, and accessing financial information.

Fintech apps employ various monetization strategies. Here are some of the popular methods includes:

- Transaction fees: Charging a small percentage or fixed fee for each financial transaction conducted through the app.

- Subscription fees: Offering premium features or services through subscription plans.

Advertising: Displaying targeted ads within the app. - Partnerships and affiliations: Collaborating with financial institutions or service providers and earning commissions or referral fees.

The process of developing a financial app typically involves all the steps of a software development practices such as:

- Gathering requirements and defining the scope of the app.

- Designing the user interface and user experience (UI/UX) of the app.

- Developing the front-end and back-end of the app.

- Integrating with financial APIs and systems.

- Implementing security measures and ensuring regulatory compliance.

- Testing the app for functionality, performance, and security.

- Deploying the app to relevant app stores.

- Continuously monitoring and enhancing the app based on user feedback.

To optimize the cost of developing a financial app, there are many factors that can be considered such as:

- Clearly define your requirements and prioritize features.

- Use agile development methodologies for efficient iteration and flexibility.

- Leverage existing fintech platforms and APIs to avoid building everything from scratch.

- Consider outsourcing development to countries with lower labor costs.

- Plan for scalability to accommodate future growth without significant rework.

Yes, as a full scale digital transformation company, we provide information, guidance, and development solutions on working with blockchain technology, smart contracts, and cryptocurrencies.

The time required to build a financial app depends on factors like the complexity of features, integrations, team size, and development approach. It can range from a few months for a basic app to a year or more for complex applications. Proper planning, resource allocation, and efficient development practices can help streamline the process.

Plaid is a widely-used API platform for banking and financial services integration. We have many developers who have successfully integrated Plaid APIs into business applications to enable secure access to banking data and transactions.