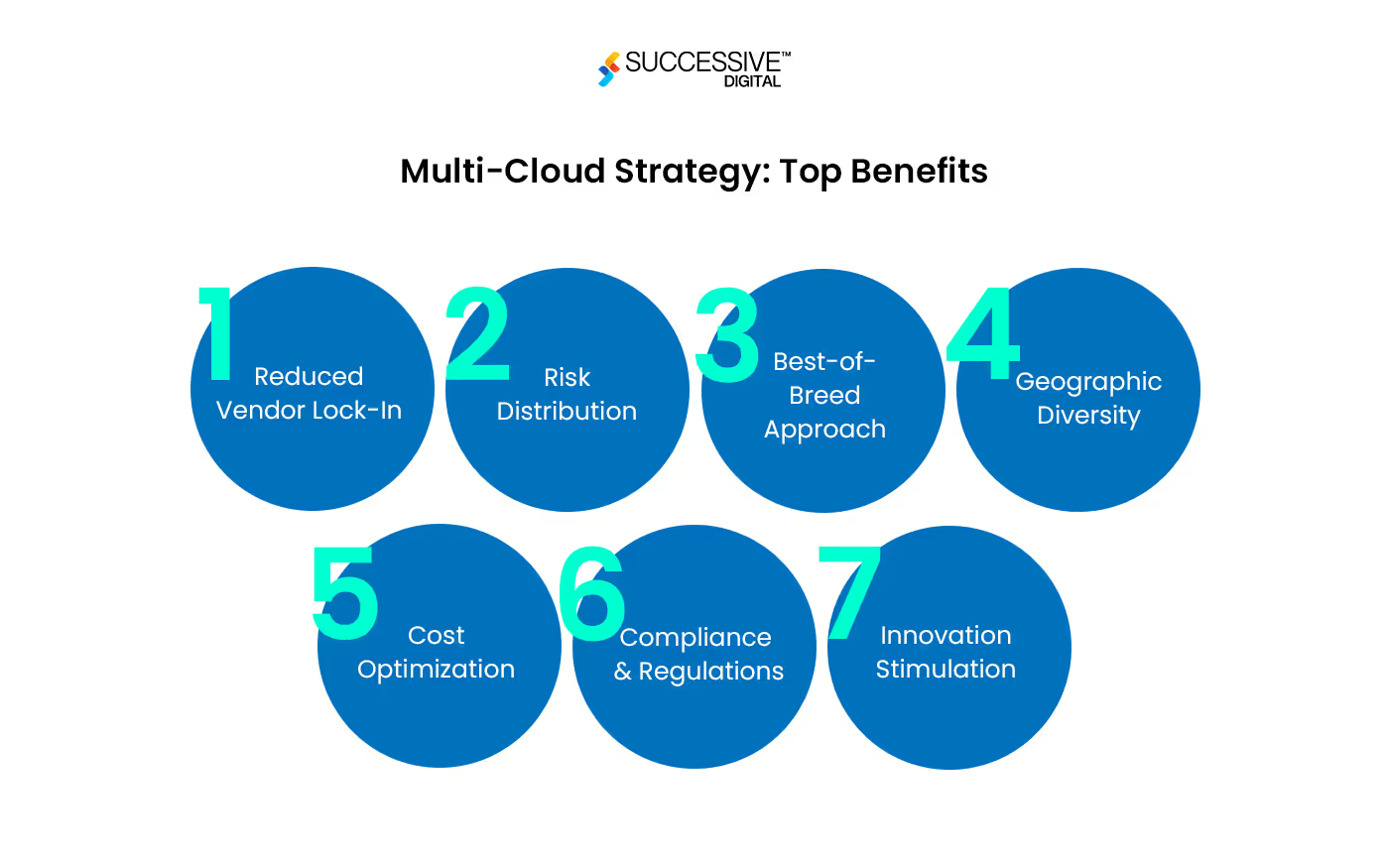

Cloud technology has fundamentally transformed the operational landscape of financial institutions, allowing them to streamline operations, increase customer experiences, and preserve aggressive competition in an evolving market. The benefits of a multicloud environment have emerged as a critical necessity for banks aiming to harness the power of cloud computing while managing risks and optimizing overall performance.Managed multi-cloud services provide banks with a strategic framework for adopting cloud technologies. This approach enables the utilization of a diverse array of cloud solutions and services in a cohesive manner, empowering banks to leverage the unique strengths of various cloud vendors. With the benefits of multicloud that distributes workloads across multiple cloud environments, banks can enhance resource usage, scalability, and operational performance, thereby fortifying their resilience for the future.This blog explores the multiple benefits banks derive from adopting managed multi-cloud offerings and structures, encompassing components including better data security, regulatory compliance, disaster recovery, and business continuity. Banks can navigate the complexities of current finance challenges with agility through the strategic adoption of the cloud and leveraging the benefits of a multicloud environment.

- Enhanced Operational Efficiency

Enhanced operational performance stands as a cornerstone benefit of multicloud assisting banks in leveraging managed cloud services. By distributing workloads across multiple cloud platforms, banks can optimize resource allocation, streamline processes, and scale performance. Banks can also deploy, manage, and ramp up their infrastructure and applications with unprecedented agility and precision through state-of-the-art orchestration tools and automation presented through controlled multi-cloud vendors.Furthermore, the flexibility inherent as benefits of a multi-cloud environment allows banks to tailor their cloud structure to specific enterprise requirements, maximizing performance. For instance, a bank may utilize AWS's strong statistics analytics capabilities, harness machine learning (ML) services of Google Cloud, and leverage Azure's compliance and safety features, all inside a single managed multi-cloud framework. This diversified technique not only optimizes overall performance but also fosters innovation by allowing banks to capitalize on the unique strengths of every cloud provider.By dynamically adjusting resource allocation based on demand, banks can also optimize costs. With real-time monitoring and analytics skills, banks can identify inefficiencies and eliminate unnecessary expenses. This proactive approach to resource management ensures that banks can deliver high-performance services to clients while optimizing operational costs, driving long-term efficiency and competitiveness in the digital banking landscape.

- Robust Data Security and Compliance

Robust statistics security and compliance are paramount for banks in the digital age and the benefits of multicloud offer complete solutions to these critical needs. By leveraging superior encryption techniques, identification and access control protocols, and continuous monitoring tools, managed multi-cloud providers fortify the security posture of banking infrastructure and applications. Additionally, the benefits of multi-cloud environment also include compliance with stringent industry regulations, which include GDPR, PCI DSS, and SOC 2. Cloud vendors offer robust auditing and reporting competencies, enabling banks to demonstrate adherence to regulatory requirements and undergo third-party tests seamlessly. This proactive technique to compliance minimizes legal and reputational dangers, instilling consideration amongst customers and stakeholders.

- Scalability and Flexibility

Scalability and flexibility are benefits of a multicloud environment that extend banks with potential for banks to navigate the ever-evolving space of digital finance with managed multi-cloud offerings and extraordinary solutions to these dynamic desires. With managed multi-cloud structures, banks can seamlessly scale infrastructure and services to meet changing needs without the limitations of conventional IT setups.Banks can install new applications, alter compute and storage sources, and adapt to fluctuating workloads in real time using automation equipment and orchestration capabilities. These benefits of multicloud including agility helps banks to capitalize on rising possibilities, accelerate time-to-market for new products and services, and maintain an aggressive position in the digital marketplace. Moreover, multi-cloud environments offer banks a strategic advantage by avoiding vendor lock-in and maintaining negotiation power with cloud vendors. By diversifying their cloud portfolio, banks can mitigate the risks of price hikes, service outages, or technology obsolescence. This ensures long-term sustainability and cost-effectiveness.

- Improved Disaster Recovery and Business Continuity

Improved disaster healing and business continuity capabilities are benefits of a multicloud environment that are paramount for banks, given the essential nature of their operations and the potential impact of disruptions on economic balance and customer acceptance. Managed multicloud offerings not only offer strong solutions to enhance resilience but also ensure uninterrupted operations, even in the face of unexpected events, providing financial institutions with the security of continuous business flow.Banks can establish redundancy and resilience by replicating statistics and workloads throughout multiple cloud environments, mitigating the chance of data loss or application downtime. Managed multicloud vendors employ advanced replication technology, automated procedures, and real-time tracking tools to limit recovery time objectives (RTO) and recovery point objectives (RPO), maintaining business continuity.Moreover, the benefits of multicloud services allow banks to conduct comprehensive disaster recovery and simulations without disrupting production environments. This proactive technique enables banks to discover and address potential vulnerabilities, validate recovery techniques, and ensure compliance with regulatory mandates, bolstering resilience and self-belief in their IT infrastructure.

- Enhanced Customer Experience

Enhanced customer experience is a cornerstone of success in the competitive banking space, and managed multi-cloud play a pivotal role in elevating the best of interactions between banks and their clients. Banks leverage the benefits of a multicloud environment by gaining deeper insights into consumer behavior, possibilities, and desires by harnessing the power of data analytics, artificial intelligence (AI), and mastering competencies provided by multi-cloud platforms. This allows banks to offer customized product recommendations, focused marketing campaigns, and proactive customer support, fostering loyalty and satisfaction. Moreover, multicloud environments facilitate the improvement of modern digital banking offerings and applications that cater to evolving consumer expectancies.Managed multi-cloud services are not just a trend but a strategic advantage. Whether it is intuitive mobile banking apps, seamless contactless payment solutions, or interactive virtual financial advisors, banks can leverage these services to deliver compelling experiences that differentiate their brand and drive customer engagement.ConclusionThe benefits of a multicloud environment and strategic adoption of managed multicloud offerings emerge as a transformative power for banks navigating the complexities of modern finance. Cloud Consulting Services helps financial institutions and banks to leverage various competencies of a milticloud providers in a coordinated manner and optimize operational performance, strengthen data protection, ensure regulatory compliance, and extend better customer experience. As the financial industry's digital transformation journey continues to grow, managed multicloud services will undoubtedly play a pivotal role in shaping the destiny of financial institutions, empowering banks to innovate, thrive, and position a competitive footfront in an ever-evolving digital world.

.avif)

.jpg)