Following the global economic crisis, significant shifts commenced to resonate in the banking and financial services sector. Dissatisfaction with conventional systems sparked a technology of innovation, giving rise to digital transformation in finance or Fintech. This fusion of finance and technology has fundamentally altered banking, democratizing access to financial services and established norms.

The evolution of digital transformation in banking indicates more than mere technological progress; it embodies an essential change in how users view and interact with financial institutions. From the introduction of mobile solutions to the substantial adoption of blockchain technology, Fintech has opened ways for smart finance, empowering individuals and companies to manage their financial processes. Furthermore, fintech has spurred a shift in user expectancies, calling for seamless experiences, personalized services, and accelerated accessibility.

This blog explores the Fintech revolution as it becomes evident that its impact extends beyond comfort; it holds the capability for economic inclusivity, empowerment, and systemic robustness. Today’s Fintech solutions reshape the banking and financial offerings space, from improving customer experience to revolutionizing risk control and compliance.

Key Technologies Driving Fintech Innovation:

-

Blockchain and Distributed Ledger Technology (DLT)

DLTs have emerged as disruptive forces in the financial industry, driving digital transformation in banking and financial services and imparting stable and transparent solutions for transactions and data management. By decentralizing and dispensing data throughout a network of computer systems, blockchain ensures immutability and tamper resistance.

Smart contracts, built on blockchain, automate processes and eliminate intermediaries, streamlining operations and decreasing expenses. DLT’s potential extends beyond simple finance, promising applications in supply chain management, healthcare, and more.

-

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing the financial landscape by allowing data-driven decision-making and customized offerings. AI algorithms analyze enormous amounts of monetary information to derive insights, expect market trends, and determine risks.

ML algorithms continuously learn from statistics, improving accuracy and performance over the years. Chatbots and digital assistants powered by AI provide instant customer support, while robo-advisors provide tailored funding recommendations, improving user experience and operational efficiency through digital transformation in investment banking.

-

Big Data Analytics

Big Data Analytics has become a cornerstone of modern finance, leveraging big volumes of financial data to extract valuable insights and extend better decision-making. By studying consumer behaviour, marketplace trends, and past transactional data, financial institutions can discover patterns, banking interaction trends, and correlations that had been formerly inaccessible.

These insights allow personalized services, threat control techniques, and operational optimizations. Through advanced analytics strategies, including predictive modeling and statistics visualization, Big Data Analytics, along with digital transformation in finance and accounting, empowers financial companies to stay competitive and agile in an unexpectedly evolving landscape.

-

Mobile Technology

Mobile technology has transformed the banking and financial ecosystem, helping users with convenient banking services at their fingertips. Mobile banking apps offer a range of functionalities, such as account control, fund transfers, bill payments, and smart deposits, anytime, anywhere.

Furthermore, contactless banking solutions and digital wallets facilitate seamless transactions in-store and online, improving convenience with advanced security. With the proliferation of smartphones, mobile technology has become vital to modern banking, driving better user engagement and satisfaction.

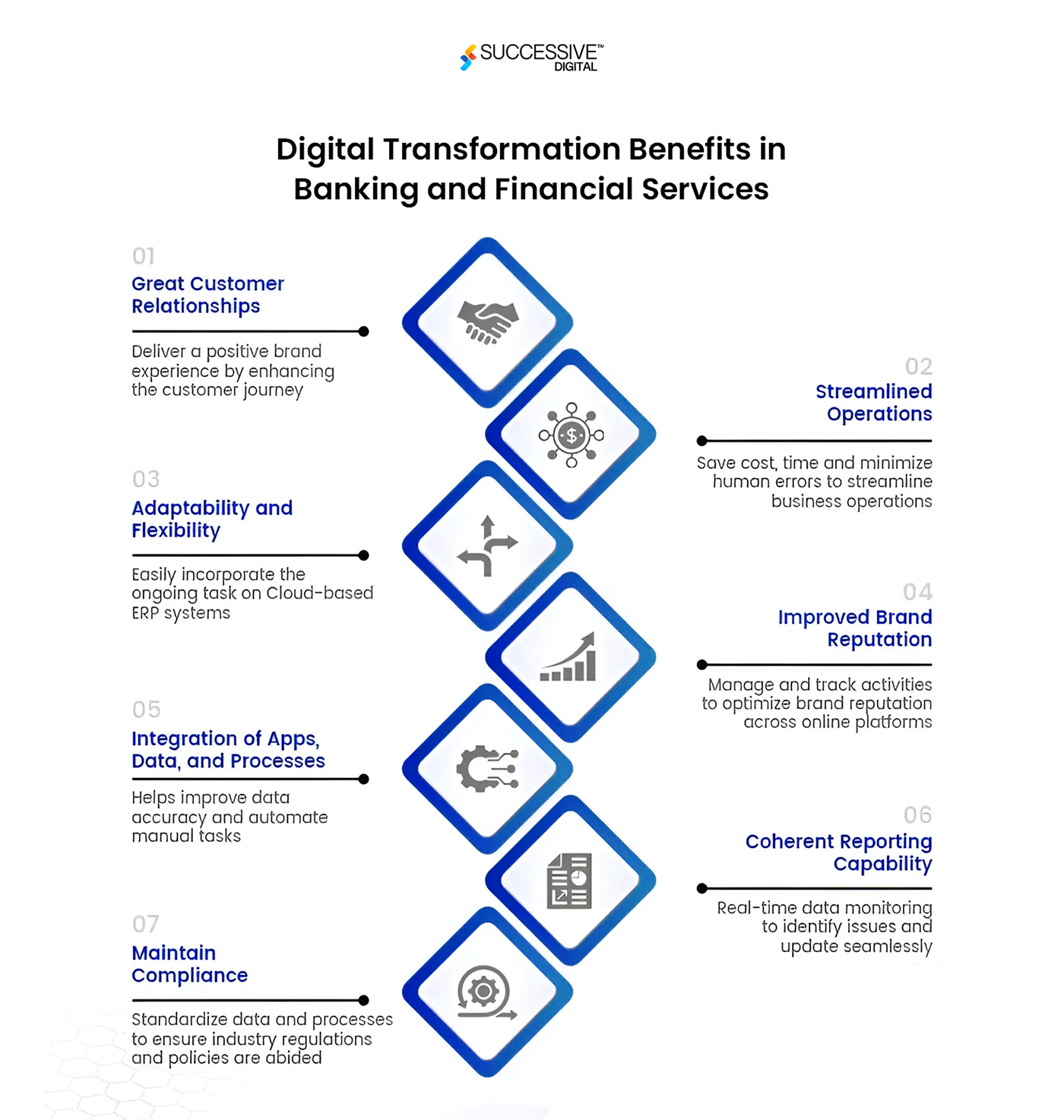

Impact of Technology on Banking and Financial Services

Enhanced Customer Experience

Enhanced customer experience in fintech encompasses intuitive interfaces, customized services, and faster transactions. AI-powered chatbots offer real-time guidance, whilst mobile apps streamline routine banking tasks. With seamless experience and tailored services, fintech companies prioritize user satisfaction, fostering their brand acceptance and loyalty in an increasingly aggressive space.

Risk Management and Compliance

Risk management and compliance play a crucial role in the fintech ecosystem, making sure security, trustworthiness, and adherence to banking rules. Fintech makes use of state-of-the-art algorithms and predictive analytics to assess risk elements, discover fraudulent behaviors, and uphold compliance with regulatory standards. AI-driven fraud detection mechanisms immediately examine transaction patterns, minimizing dangers and fortifying defenses against economic misconduct. Moreover, blockchain technology complements transparency and accountability, simplifying regulatory compliance and lowering the chances of fraudulent transactions and data breaches.

Financial Inclusion

Digital transformation in Finance has enabled financial inclusion, an essential purpose of fintech, that aims to offer access to banking and economic offerings to underserved populations worldwide. Through mobile platforms, peer-to-peer lending networks, and digital banking solutions, fintech bridges the distance, empowering individuals with access to credit scores, savings, and payment solutions. By democratizing finance, fintech fosters banking empowerment, reduces poverty, and promotes sustainable improvement, unlocking possibilities for financial inclusion and prosperity for all.

Conclusion

The transformative effect of Fintech on banking and financial services is undeniable, with improvements that include mobile banking solutions, blockchain technology, and AI-driven offerings revolutionizing the industry. Beyond comfort, digital transformation in finance promises financial inclusion, empowerment, and systemic resilience. Collaboration between traditional establishments and Fintech startups may be vital in navigating regulatory challenges and maximizing the advantages of those innovations. As Fintech continues to evolve, its potential to enhance user experience, streamline operations, and economic inclusion will form the future of the global finance landscape.