With the prevalence of cross-border commerce, the online trading landscape has gone through a transformation. The ease of transaction processing has created a truly borderless yet interconnected digital marketplace where entrepreneurs can thrive and consumers can enjoy unparalleled convenience in their purchasing experiences.

We live in an era where online shopping and e-commerce business solutions are evolving, shaping the future of economies and redefining the traditional boundaries of commerce. Thus, businesses must go global with cross-border transactions and international payments to succeed in the modern world.

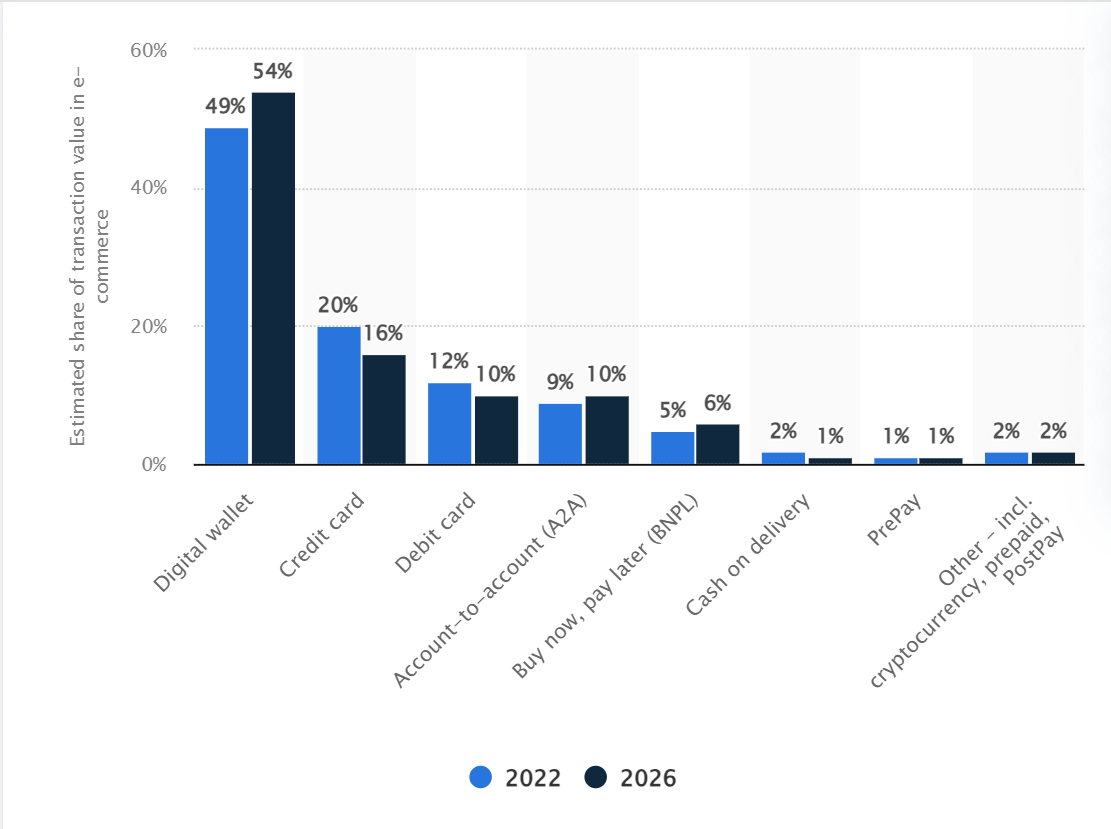

Digital and mobile wallets are a leading choice for making online purchases in regions like Asia Pacific, Latin America, the United Kingdom, and the USA. The transaction value with digital payment methods is expected to reach US$ 11.55 trillion in 2024. Moreover, it projects an annual growth rate of 9.52%, estimating a total of US $16.62 trillion by 2028. As a result, businesses collaborate with a reputed eCommerce app development company to build custom checkout solutions and integrate secure payment gateways that enable seamless international transactions.

E-commerce Payment Integration and Function Explained

Online shopping websites and applications utilize seamless API integration to facilitate a safe and smooth purchase process between businesses and customers. Payment gateway services and plugins can be offered directly by banks or other payment service providers.

Types of Online Payment Gateways

-

Hosted Payment Gateway

Under this payment method, customers are redirected from the eCommerce app’s checkout page to the payment gateway website or application to complete the payment processing. This is a fast, convenient, and cost-effective method to enable digital payments.

-

Direct Post Payment Method

This payment method is offered by third-party service providers. However, customers do not have to leave the eCommerce app to complete the transaction. This helps to maintain a consistent user experience and smooth checkout process.

-

Self-hosted White-label Payment Gateway

A self-hosted payment gateway integrates into the eCommerce application, allowing businesses to tailor and control the transaction process within the infrastructure. These payment gateways are integrated via ready-to-use or custom APIs, handling end-to-end payment processing.

-

Self-hosted Custom Payment Gateway

In this payment method, businesses get to design and integrate a payment gateway directly into the eCommerce app using custom APIs and the checkout process. This allows merchants to have complete control over the payment processing flow while incorporating unique functionality with minimized complexity. Additionally, third-party payment processors are eliminated in this method, reducing security risks.

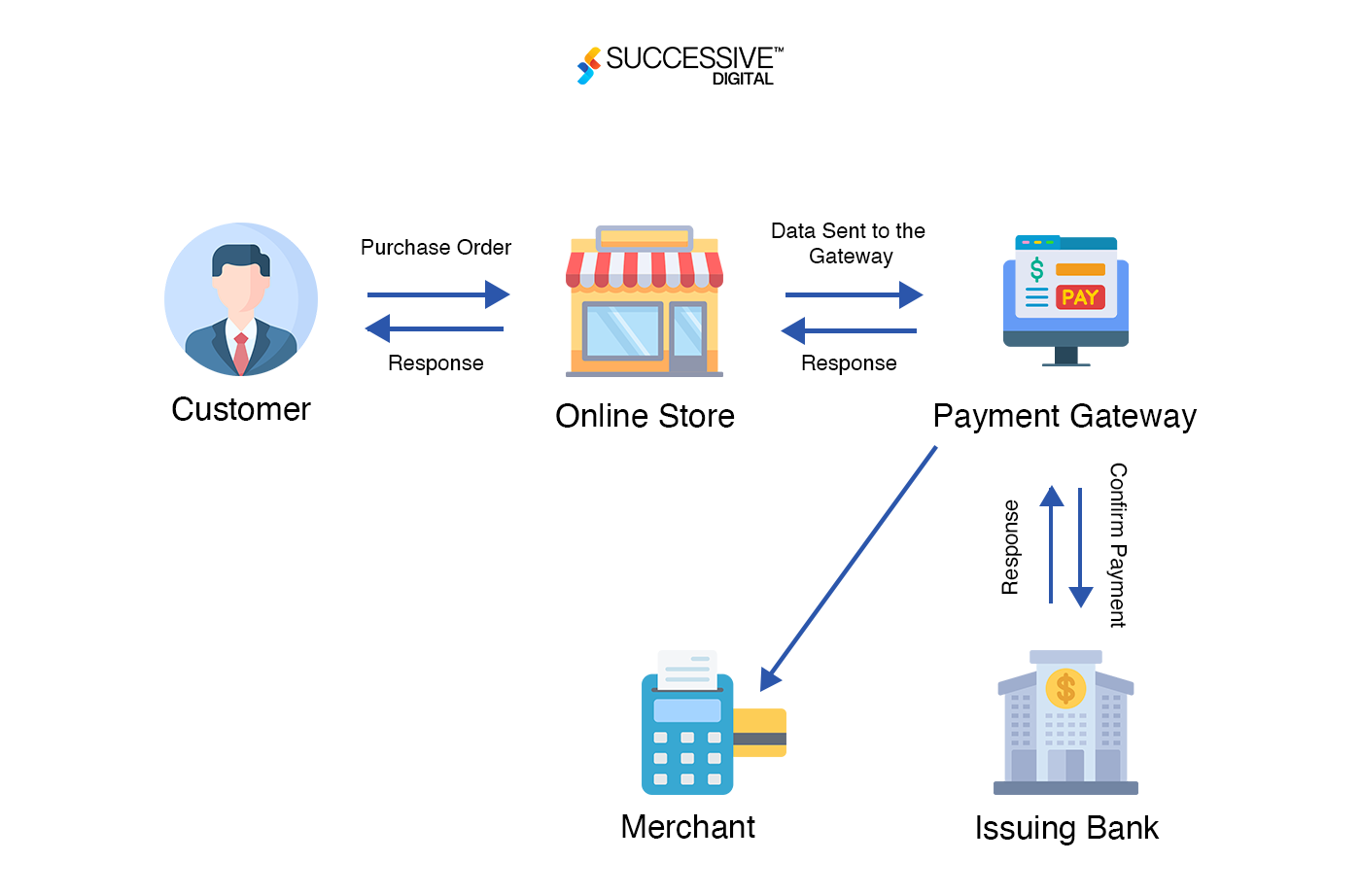

How Payment Gateways Functions in eCommerce Apps

Step 1: Customer requests a payment from the merchant.

Step 2: The request is sent to the payment gateway via an encrypted SSL channel.

Step 3: The details are sent to the issuing bank through payment processors.

Step 4: The customer’s bank inspects the balance. Based on that, the issuing bank can deny and authorize the payment accordingly.

Step 5: The customer then gets notified about the payment.

Step 6: After the customer authorizes the bank to accept the amount, the funds are transferred to the merchant account.

Step-by-Step Process of Payment Gateway Integration in eCommerce Apps

Using payment gateway APIs, eCommerce stores can facilitate faster checkout processes with mobile-friendly interfaces. Moreover, it enables merchants to create a compliant-friendly and customized payment process.

-

Plan the Project Scope of eCommerce Payment Integration

Begin by selecting the third-party payment gateway aligning with your business requirements and objectives. Also, how compatible it is with your eCommerce platform and features will affect your choice.

-

Set up a Merchant Account

Depending on the payment gateway, you can analyze the potential regulatory risks and compliance requirements, e.g., PCI DSS requirements. Also, the set-up of a merchant account will be dependent on payment gateway providers.

-

Obtain the API Credentials and Design the Integration

The next step is to design an architecture and a user flow for the application with a focus on functional and non-functional requirements. Once you finalize and set up the design, the next step is to obtain API keys. These credentials enable secure communication between the eCommerce app and the payment gateway server.

-

Configure and Test the Payment Gateway

Based on the payment gateway service and eCommerce platform you choose, the configuration of your payment process varies. For instance, platforms like Shopify or WooCommerce offer plugins and extensions, ensuring streamlined payment integration. Otherwise, add manual code during your eCommerce app development process.

Furthermore, you should test the eCommerce application payment processing to see if it is functioning properly.

-

Launch the eCommerce App With Payment Integration

When your eCommerce application is fully functional and the integrated payment gateway works as intended, you can make it live. Moreover, focus specifically on data security throughout the transaction process. Besides, your platform should be compliant with the Payment Card Industry Data Security Standard (PCI DSS) and maintain privacy with encrypted connections.

Popular Payment Solutions to Integrate in eCommerce Apps

What are the payment methods for eCommerce apps? This must be your major concern as a reliable business owner. Your eCommerce business can leverage a variety of payment methods targeting your customer’s needs.

Source: Statista

Credit and Debit Cards

Most eCommerce apps allow customers to pay through credit/debit cards. This common type of payment solution enables a fast and convenient transaction process.

Digital Wallets

With digital wallets like PayPal, Apple Pay, and Google Pay being popular payment methods, eCommerce apps integrate them, enabling quick payment with a few clicks.

Electronic Funds Transfers (EFTs)

Customers transfer money from their bank accounts to the business’s bank accounts through these transactions. These types of payments are typically popular in Europe and Asia.

Cash on Delivery (COD)

This is a widely known payment method for eCommerce applications where customers pay for their purchases when they receive the parcel. This payment method is suitable primarily in countries with low credit and debit card usage.

Buy Now, Pay Later

This payment method allows customers to place their purchase orders readily and make charges later. Businesses permit them to delay the payment as per their convenience, often with interest or fees.

Smart Cards/ Prepaid Cards

These are payment methods similar to debit cards you can use to make purchases. You can buy a card with a specific amount loaded in it and pay the amount with it just like a regular debit card.

Top Payment Gateway Service Providers for eCommerce Apps

Various third-party payment service providers offer unique features for a seamless checkout process, assisting your eCommerce business with specific digital payment processing needs.

PayPal

PayPal is one of the widely used payment gateways by customers; thus, businesses prefer to integrate it into their eCommerce applications. The checkout customization features and fraud protection security make it a popular eCommerce payment gateway integration choice.

Features/ Benefits:

- Robust buyer protection policies.

- Global acceptance and recognition.

- Support multi-currency transactions with businesses reaching over 200 countries.

- Enable one-touch checkout.

- Easy splitting of payments among multiple recipients.

Stripe

With a focus on banking-as-a-service, mobile ecommerce, and platform-based payments, Stripe offers various unique features tailored to your business needs.

Features/ Benefits:

- Highly customizable checkout experiences.

- Seamless integration with robust APIs and developer tools.

- Advanced subscription management features.

- Detailed real-time reporting and analytics.

Amazon Pay

Amazon Pay allows customers to utilize their existing Amazon accounts to make purchases on third-party eCommerce applications. Several merchants use Amazon Pay as their payment solution on their e-commerce applications and websites.

| Country | Number of Applications/ Websites Using Amazon Payments |

| United States | 1million+ |

| United Kingdom | 95k+ |

| Australia | 78k+ |

| Germany | 62k+ |

| Canada | 56k+ |

Source: Statista

Features/ Benefits:

- Trust and familiarity associated with the Amazon brand.

- The quick purchase process through saved payment.

- Integrating the growing trend of voice commerce with Alexa.

- Provide access to customer data and insights.

Square

Powering millions of businesses with a smart and efficient payment gateway, Square is one of the most advanced solutions for eCommerce applications. Moreover, by managing cash flow and diversified revenue, you can fulfill your business goals with this payment gateway.

Features/ Benefits:

- Hardware solutions for in-person payments.

- Integrated inventory management tools.

- Allows businesses to create and send customizable invoices.

- Support contactless payments.

Best Practices/ Features to Add in Custom Payment Gateway in eCommerce Apps

Compare different payment options and your project requirements and select the features to optimize the checkout experience for your customers.

Support Multi-currency

To leverage an actual cross-border commerce application, businesses integrate real-time currency conversion and display prices in the shopper’s preferred currency. This is a significant feature enabling merchants to trade internationally.

Mobile-Optimized Checkout with Auto-Read OTP

While developing payment gateway eCommerce apps, the focus should be on designing a smooth checkout experience with a mobile-first approach. With the implementation of SMS OTP auto-read functionality aligning with PSD2 SCA requirements in mobile apps, you can elevate user experience and convenience.

In-built Tax Calculator

An advanced tax calculator incorporated in your payment gateway makes the entire process nearly accurate, reducing discrepancies or errors automatically. With automation in VAT-based tax calculation, your checkout process enables conclusive and precise tax payments in minutes with just a few clicks.

Multi-Language Support and Localization

Your payment page should localize the content and formats (e.g., date, currency) based on user preferences or detected location. This breaks down the language barrier for your business, creating a rich cross-border commerce experience and ultimately increasing revenue.

Regulatory Compliance for Cross-Border Sales

Ensure your custom payment gateway meets PCI DSS security requirements and standards, indicating its robust security measures safeguarding sensitive card data. Moreover, integrating Strong Customer Authentication (SCA) as part of PSD2 requirements using 2FA methods makes the payment process easier and safer.

How to Develop a Custom eCommerce Payment Gateway from Scratch?

Depending on the project specifics, duration, and approach, you can integrate the payment gateway into your eCommerce application. Below, we have described the steps for designing the custom checkout and payment procedure from scratch.

Planning and Feasibility Study

First, the consultants will thoroughly analyze your eCommerce app idea, objectives, features, and unique payment handling needs. Additionally, they will be assessing your current IT infrastructure to find out the feasibility of custom payment gateway development for your business.

Design the eCommerce Payment Gateway Solution With Required Compliance and Security

A custom payment gateway solution must comply with all suitable regulatory requirements, such as PCI DSS and AML & KYC. Moreover, it should fulfill all non-functional requirements for the payment gateway, including performance, scalability, availability, and integrity.

Define Development Tools

The next phase includes deciding the tools and technologies required to develop your eCommerce app’s custom payment gateway solution. Your tech stack must align with the relevant corporate solutions and external systems, focusing on fast development and minimizing project costs.

Build Back-end Solution

Your team of experienced app developers will be building the custom payment gateway. This includes setting up the development and delivery automation environments, including CI/CD pipelines and container orchestration, along with developing custom APIs.

In addition, your development team will implement a secure database to store and manage the customer’s sensitive data. Also, the developer will invest considerable time in ensuring a streamlined customer experience with the checkout page and admin interface.

Want to know how you can design a unique workflow to boost customer satisfaction and sales? Read our blog on Custom Ecommerce App Development Solutions, shedding light on tailored app development practices, features, and functionalities.

Test to Validate the Quality of Custom Payment Gateway

The goal is to develop a secure and high-performing payment gateway. This can be done through a meticulous quality assurance process to fix the defects before deployment and validate the quality of the payment gateway.

Deploy and Integrate the Payment Solution

Once the payment gateway is developed and passes all the functional and non-functional testing requirements, it can be configured and deployed to the application’s infrastructure.

Moreover, confirming that your custom payment gateway eCommerce apps keep working seamlessly and are employed with well-protected infrastructure is crucial. Therefore, it is recommended that authorization controls be implemented for APIs, DDoS protection algorithms, firewalls, IDSs / IPSs, DLP systems, and other security tools.

Evaluating the Cost of eCommerce Payment Integration

The chosen payment gateway integration method is the significant factor affecting the cost of developing secure payment solutions for eCommerce apps, i.e., third-party services or custom solutions. Moreover, the complexity of payment solutions and eCommerce apps is crucial in defining the budget invested in eCommerce payment integration.

Additionally, consider the set-up fees for a merchant account and various functional requirements of an integrated system to estimate the final cost of payment gateway integration.

| Types of Payment Gateway Solutions | Cost | Timeline |

| Third-party Payment Gateway Integration in eCommerce Apps | $30K–$100K+ (Depending on integration complexity) | 2-5+ months on average |

| Custom Payment Gateway Integration in eCommerce Apps | $100K–$300K+ (or more based on the additional requirements) | 6-11+ months on average |

Why Choose Successive Digital for Online Payment Gateway Integration?

Providing powerful eCommerce solutions to industries of various dynamics for over a decade, Successive Digital is experienced in covering end-to-end integration of online payment gateways. With our analytics-driven digital transformation approach, we, as a reliable eCommerce app development company, help companies design secure and ideal custom payment solutions.

Keeping customer-centricity as our focal point, we have deployed various scalable solutions touching all digital touch points. Our compliant-friendly custom payment gateway integration fits growing needs and emerging technologies, making a massive difference in how you conduct your business.

Take a look at our Digital Integrated Payment System, where we helped them with complete digital transformation through advanced consulting and development solutions. We enhanced feature-rich payment and billing experiences with autopay enrollment, multilingual capabilities, digital utility bill payment, real-time payment, autopay enrollment, and more.

Frequently Asked Questions

A payment gateway is an online payment service for sending and accepting payments between customers and merchants over the Internet. Although this term also includes the physical card-reading devices found in brick-and-mortar stores, it is widely used for payment processing portals in online stores.

In eCommerce stores, payment gateways are integrated into the checkout portal, where customers can complete transactions using a credit card, digital wallet, or other methods. Moreover, even physical retail stores now accept mobile payments through QR codes or Near Field Communication (NFC) technology.

Many payment portals, including Stripe, PayPal, Amazon Pay, and more, are available in the market. Considering the mobile platform you choose to deploy your eCommerce application, development budget, and project scope, decide on a payment gateway that can meet your business needs.

Moreover, eCommerce platforms like Shopify, WooCommerce, and PrestaShop are compatible with specific third-party gateways— For example, Shopify with PayPal, Stripe, & Authorize.Net and WooCommerce with PayPal, Stripe, Square, and Amazon Pay.

The smooth technical integration with a payment gateway largely depends on the third-party or custom integration. Moreover, factors like scalability, time-to-market, system architecture, and seamless integration between Merchants, Buyers, and Marketplace Operators must be considered for payment gateway integration.