With the massive adoption of smartphones and how handy they come for people from all walks of life, mobile payment options are becoming mainstream all across the globe. A digital wallet or e-wallet is one of the popular contactless payment methods used by people to handle their money digitally.According to Statista, mobile wallets are already a preferred payment method in e-commerce among people in the U.S. Whereas ApplePay and GooglePay will lead the future of mobile payment where the number of people who use Apple Pay is expected to grow by nine million between 2022 and 2026.If you are a business owner looking to increase your offerings and convenience for your target audience or a startup wanting to be a part of a market that has highly exponential growth in the future, digital wallet app development at this time would be a lucrative option.In the following blog, we will reveal all critical aspects of what it takes to create a digital wallet app like cost, top features, processes, security & compliance integration, technology stack, and others so that you can set the right foundation for your payment app development business.Table of Content

- What Is Digital Wallet?

- Advantages Of Digital Wallet App For Customers

- Advantages Of Digital Wallet Development For Businesses

- How Do These Digital Wallet Applications Work?

- Types Of Digital Wallet Applications

- Key Features To Include In Digital Wallet App Development

- Step-By-Step Guide For Digital Wallet App Development

- Popular Technology Stack Used For Digital Wallet App Development

- Security Compliance For Digital Wallet Application Development

- 7 Most Popular Digital Wallets Across The World

- List Of Industries That Benefit From Mobile Wallet Application

- Reason to Invest In Digital Wallet App Development

- What Is The Cost Of A Digital Wallet App Development?

- Our Expertise in Creating Digital Wallet Apps

- Conclusion

What Is Digital Wallet?

A digital wallet is a software application that serves as an electronic version of a physical wallet. With a digital wallet, you don’t need to carry along your physical wallet while going out or filling out your card details. All you need is your smartphone with a mobile application downloaded from a digital wallet and it ensures you have a faster and easier transaction process at eCommerce sites, merchant shops, malls, and other places from where you want to buy something or need to transfer money for any reason.To use a digital wallet, all you have to do is to download the application to your smartphone and register your debit or credit card details within the application. These applications store your financial information in a form of a token along with your device number known as a cryptogram as a virtual identification number. These tokens and cryptograms are further used by digital wallet applications to validate your identity when you want to send money to someone or pay for buying something with the application.Digital wallet apps remove the need to insert the card into POS terminals or swap them and enter security pins. These applications promote contactless payment along with excellent security, making them the most popular and highly convenient choice to do payment anywhere. According to industry experts, mobile wallet application development is just the beginning of a new era. Besides storing payment methods, FinTech leaders are also developing a complete ecosystem of digital wallet applications. It wouldn’t be wrong to say that digital wallets will remove the need for physical wallets in the upcoming time as these wallets are also designed to hold a wider range of digital items people used to carry within physical wallets, including:

- Gift cards

- Loyalty cards

- Coupons

- Reward points

- Driver’s licenses

- Plane tickets and boarding passes

- Event tickets

- Membership cards

- Insurance cards

- Coupons

- Hotel and restaurant reservations

If you are still not convinced why you should jump onto building a digital wallet app, as a digital wallet app development company we would like to discuss with you the advantage of digital wallets for both businesses and customers. Let’s explore a few of them:

Advantages Of Digital Wallet App For Customers

- Convenience: Mobile wallets enable transactions to be completed instantly without waiting in long lines or going to an ATM to withdraw cash.

- Easy & Quick: With a mobile wallet, you don't always need to keep entering your card number, expiry date, and CVV, to do transactions. Just pick up your phone, scan the QR code and you are done. It's that easy!

- Easily Accessible: Since a mobile wallet resides within your smartphone, it's always accessible and supports day-to-day transactions faster and more easily.

- Wide range of users: The reach of mobile wallets has gone far and wide as it can be used for bill payments, water, electricity, water, flight tickets, buses, trains, and many other things.

- Never miss a payment: You can also enable autopay within your mobile wallet and it will pay your bills on the specified date. This lets you go about your dates hassle-free.

- Security: Your wallet can be stolen, but your mobile wallet can not. Even in the case when you lose your phone, your mobile wallet has security settings that enable only you to access it. Additionally, when data is transmitted via mobile wallet for making payments, the account number isn't communicated. Instead, encrypted payment codes or tokens are sent and received to ensure security.

Advantages Of Digital Wallet App Development For Businesses

- Better customer experience: Mobile wallets streamline the checkout process by providing fewer click-throughs and auto-fill forms. This in turn drives up conversion rates - a win-win for businesses and customers alike.

- Secure financial detail: Protecting cardholder details is vital for your business, as any security breach can create a serious hit to your reputation. Digital wallets add an additional layer of security with the use of biometrics like fingerprint and face recognition technology and secure users' financial data.

- Serve as an alternative payment option: Mobile wallets can be used as an alternative payment option for customers as not all customers like carrying cards or cash especially Generation Z. Having a contactless payment option in place allows you to accept payment from the new generation people who are always in a hurry or prefer digital means for everything. Digital wallets also allow you to accept payments like Bitcoin or direct PayPal payments.

- Insights into customer shopping habits: Digital wallets help a business beyond payment transactions. It also provides real-time data analysis of customers' shopping histories and preferences, which facilitates a more targeted marketing campaign. Using the same, a business can also manage inventory and create more accurate budgets.

How Do These Digital Wallet Apps Work?

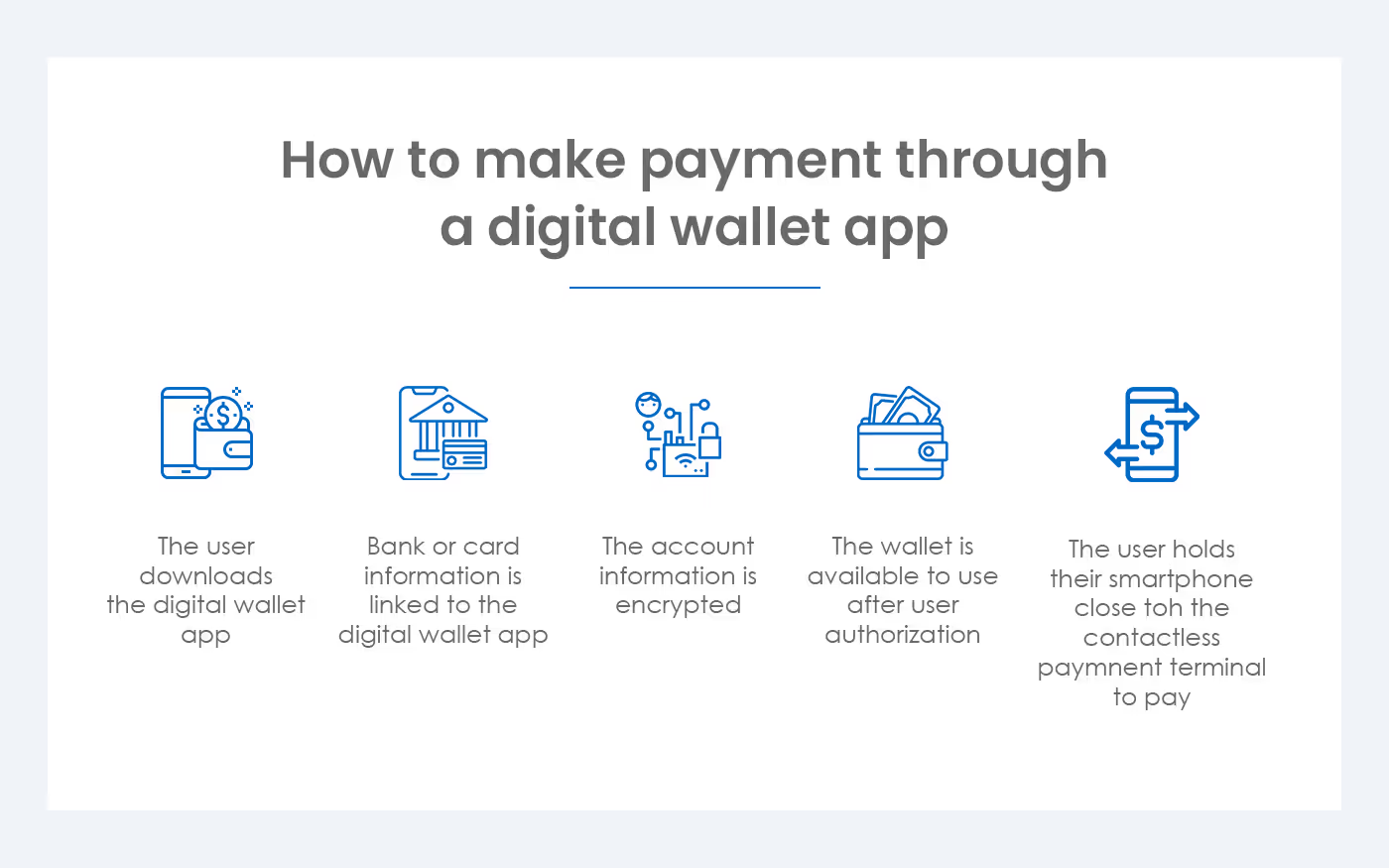

Since this post is dedicated to helping you understand how to create a digital wallet, it is also important to discuss how these digital wallet apps work. Here is the following steps performed by the user to use the application:

- A user downloads the digital wallet application.

- The user registers his card details into the application.

- The application stored the bank or card details in an encrypted way.

- To pay with a digital wallet, the user passes his authentication based on his OS device.

- He holds his smartphone close to the contactless terminal or pays using his mobile. number by authorizing the transaction with further security processes implemented within the application.

In order to complete this cycle, there are several technical processes that work behind the mobile wallet application to make the transaction work such as quick response code, near-field communication (NFC), and magnetic secure transactions (MST). While working together as a complete payment processing cycle, digital wallets offer users a faster, more secure, and satisfactory payment experience.As an experienced fintech app development company, we help you (startups and companies) build and customize mobile wallet applications based on your unique business needs. Let's know these technical processes in detail to understand how these are enabling payment through a mobile wallet and fostering contactless payment culture.

- Quick Response Codes or QR Code

QR code is a type of machine-readable code or barcode that typically stores information as a series of pixels in black-and-white square format. These barcodes are readable by a camera of a smartphone and this thing has unlocked an entirely new way to make a payment.When scanned through a smartphone camera, it directs the user to access the relevant information and make hassle-free payments online. QR codes are truly a multifaceted shortcut to the internet with which within a few seconds users can make a contactless payment with zero effort, enabling a stress-free customer experience.

- Near Field Communication (NFC):

Near field technology or NFC is a method of wireless data transfer that uses electromagnetic signals to enable smart devices like smartphones, laptops, tablets, and other devices to share and transfer data when in close proximity. Using NFT in developing digital wallets allows you to power wallet users (sender) and businesses (receiver) for contactless payment processes.However, near field communication payments require the merchant's terminal and customer's device to be NFC-enabled. Meaning, the sender and receiver have to be within an inch and a half of each other to connect, which is also a better option to send and receive payment securely.

- Magnetic Secure Transmission (MST):

Magnetic secure transmission is another mobile payment and wireless technology that replicates payment with both traditional pre-chip magnetic stripe systems and modern no-swipe credit card terminals. If you aim for digital wallet mobile app development, especially for the United States, make sure to enable MST digital technology within the application.The US is notoriously slow in adopting new payment technology i.e. NFC. If you are expecting a quick spike in the adoption of your mobile wallet payment app, you must enable both NFC and Magnetic Secure Transmission (MST) technology as approximately 90% of merchants were accepting MST in 2022. It makes your app work with nearly all merchant payment terminals.

Types of Digital Wallet Apps

Interestingly, there are multiple options available for mobile wallet app development. You can go with the one that addresses your business model, target user's needs, location, and device’s operating system. For example, Apple Pay is a good option for iPhone users whereas Google Pay is best for users having android devices. While others use PayPal since it provides international-level acceptance. Apart from this, Venmo and Cash App work only with a valid US phone number. These are some considerations that you must decide beforehand for developing a modern and successful digital wallet app for your business. We can segregate these applications into different digital wallet categories, offering different conveniences to different users. Let's check different types of e-wallets that can be developed.

1. Closed Wallet

Closed wallet apps are applications that allow users to make payments through the application or website. But these wallets are developed by businesses that sell products or services and allow the business users to use the provided wallet for payment. In case of a canceled transaction or refund, the whole amount is credited back to the wallet that you can’t use on another platform or with other businesses.

2. Semi-Closed Wallet

A semi-closed wallet like Apple Pay or Google Pay can be developed and used as an integrated payment system between a business and a user. Semi-closed digital wallet software development allows you to play the role of an integrated payment system between merchants and customers. Whereas merchants agree to a contract or agreement with you for using the application, customers have to provide their personal details like bank or debit card number, location, and other identity verification including generating pins to ensure secure payment transactions.

3. Open-Wallet

Open wallet apps are designed to support any type of transaction. These types of wallets can be used to transfer funds and send to receive online and in-store payments. If you are developing an open wallet, make sure you facilitate transactions that can be done from anywhere in the world. These types of wallets require both sender and receiver to have accounts on the same application.

4. Cryptocurrency Wallet

Crypto wallet development refers to developing mobile apps that store and transfer cryptocurrencies. These wallets store user's public and private keys also known as ownership certificates for facilitating transactions over its application.

Key Features To Include In Digital Wallet App

Just like any other mobile application, digital wallet features also happen to incorporate three panels that address different needs of different users. It includes a user panel, merchant panel, and admin panel. Let’s know them below.

User Panel Features

- Signup via Social Login

- User authentication via pin, pattern, and Face ID

- Add authorized bank account

- Check account balance

- Transfer money via contact number or QR code scanner

- Pay bills and set a bill payment reminder

- View transaction history

- Multi-currency & multi-language support

- Chat support

- Push notifications

Merchant Panel Features

- Log in to an interactive dashboard

- Add/manage products

- Create/edit profile

- Account verification via pin, pattern, and Face ID

- Manage customers

- Add promotional offers & discounts

- Offer loyalty points and rewards

- Manage staff and employees

- POS integration

- Payment link generation

Admin Panel Features

- QR code generation

- Manage users & merchants/vendors

- Real-time analytics

- Enhance the app’s security

- Reporting & auditing

- User and merchant data control

- Transaction management

- App support and maintenance

- Dashboard management

- Manage offers

Step-By-Step Guide For digital wallet App Development

A digital wallet app development comprises the same process a digital product development process incorporates. It begins with discovery, UI/UX designing, development, testing, deployment, product launch, and maintenance and support. Let’s check each phase in detail and understand their significance in digital wallet app development.

1. Product Discovery

The first step of developing a mobile wallet app is discovering or identifying the project scope. With the help of a full-cycle mobile app development company, you can validate the business idea of developing an e-wallet app, test the idea with target users, and the technical requirements necessary to build a successful mobile application. This phase provides you with a better understanding of the complexities often involved in digital wallet system design and solution development. At this stage, each team member engages effectively with the appropriate technology stacks to validate the technical and business feasibility of the product idea.

2. Designing

In this phase, an application development company helps you give a look and feel to your e-wallet by developing a user interface and user experience for your mobile app. It will give an intuitive and visually appealing application for the user to use and test it. You can decide and build a brand logo, application icon, button, and other digital wallet features to differentiate your product from the competitors. It will serve as a design blueprint that will be used further by developers to code the application modules and establish functionalities between them to define a final product.

3. Development and Testing

Mobile app development and testing represent the most technical aspect of the process. Depending on the quality of the UI/UX, the development team deploy technology stacks, set up CI/CD, and test and validate whether the product behaves as it is supposed to.

4. Digital Wallet Application Launch

Since mobile wallets are mobile applications, these are also required to be hosted on top play stores such as Google Play and Apple Store. This way, you make your application available for download for the targeted users based on their respective operating systems.

5. Maintenance and Support

Mobile application development is a one-time job, but keeping it updated according to market needs comes under maintenance and support which is an ongoing process. Your digital wallet development company also helps with application maintenance and provides support to keep the application updated, active, and high-performing while resolving errors or bugs if occurred after launch.

Popular Technology Stack Used For Digital Wallet App Development

Backend DevelopmentPHP, NodeJS, Python, Java, etc.Frontend DevelopmentKotlin, Swift, CSS, Bootstrap, HTML 5, Vue.js, React.js, Angular, etc.Database DevelopmentMongoDB, Apache Cassandra, HBase, MySQL, Postgres, etc.Cross-Platform FrameworkIonic, React Native, Flutter, Xmarian, etc.QR Code ScanningByteScout BarCode, ZBar Code Reader, etc.AnalyticsAmazon Kinesis, Apache Kafka, Spark, Flink, etc.Cloud ServicesGoogle Cloud, Azure, Salesforce, Amazon Web Services, etc.Push NotificationsAmazon SNS, Google Firebase, etc.GeolocationGoogle Maps API (Even for iOS applications)Payment GatewaysPayPal, Stripe, Braintree, QuickPay, etc.

Security Compliance For Digital Wallet App

Despite the growing popularity, developing an android virtual wallet or iOS virtual wallet from the ground up requires considerable effort and time in putting them in alignment with regulatory compliance. According to Payment Card Industry Data Security Standard (PCI DSS), it is important to secure cardholders' information wherever it is stored. A successful digital wallet is one on which customers rely on the security structure, its commodity, and ease of use. To ensure great product delivery and performance of your mobile wallet application, you must implement the following security and regulatory structure to your digital wallet.

1. Ensure Data Privacy Compliance

You must comply with the best practices for implementing data privacy regulations according to the state or region you want the application to be operated. Some of the common regulations and compliance important to implement are General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

2. Multi-Factor Authentication

You must implement an additional layer of protection to your digital wallet app by implementing multi-factor authentication. For example, an iPhone application uses face recognition, pin, and password as well as device number to validate the authentication of the user.

2. Secure Data Transmission

In the digital world, you are required to secure data even in transit. To provide a secure and faster transaction experience on your mobile application, make sure your developer has implemented SSL/TLS/VPN encryption. These encryptions allow secure data transmission between the application and the server.

4. Secure Data Storage

You must secure user data and their financial information such as credit card details at rest as well. There are secure storage methods used such as encryption, hashing, and others that protect user’s personal information from fraudulent activity and access.

5. Regular Security Audits And Updates

With increasing cybersecurity incidents and information leaks, there is constantly growing regulatory and compliance around cybersecurity and an evolving technological environment. The consequences of data breaches are having a great reach in the financial sector, leading to higher fines and litigation. Henceforth, you must keep your mobile wallet application on regular security audits to identify vulnerabilities and implement timely security updates.

7 Most Popular Digital Wallet Apps Across The World

The digital wallet space is crowded and getting bigger. Companies like PayPal and Venmo offer digital wallet products and enable users to pay for purchases online and in person using their respective mobile applications. Additionally, many banks and credit card companies have introduced digital wallets for android and iOS devices with personalized functionalities that can only be accessed within their mobile apps. Since both customers and businesses are fostering a contactless or self-service culture around the world for payment transfer, here is a list of the top 7 digital wallets in closed, open, semi-open, and other categories used across the world.

Apple Pay

With 92% of digital wallet transactions in 2020, Apple Pay has emerged as a leader in the digital wallet space. Apple has introduced its wallet for iPhones, iPads, and Apple Watches.

Google Pay

Google Pay has maintained its leadership in the digital wallet space by having 100 million users.

Amazon Pay

Amazon has a very popular and widely accepted digital wallet in the world all thanks to being the third largest company and a fixture in ecommerce.

PayPal

PayPal’s digital wallet builds on its long history in online payments, and supports international transactions with almost all types of cards.

Click to Pay

Click to Pay was an amalgamation effort of Visa, American Express, Mastercard, and Discover. It came as a unified online payment system and works with almost all major credit cards.

Alipay

Alipay by Alibaba Group is a leading China-based digital payments platform. It had more than 1.3 billion active users in June 2020 and processed $17 trillion worth of transactions in China per year.

WeChat Pay

WeChat Pay is China's other top digital wallet with over 900 million users.

List of Industries That Benefit From Mobile Wallet Application

The adoption of mobile wallet applications has been a game-changer for various industries, helping them cater to the changing preferences and habits of customers. With payment app development, industries such as retail, banking, travel, and transportation are transforming themselves by enhancing the checkout experience to provide a more secure and seamless payment option. Let’s take a closer look at how these industries are leveraging mobile wallet applications to improve customer experience, drive sales, and stay ahead of the competition.

eCommerce

Ecommerce leverages digital wallets to offer secure and convenient payment options, streamline checkouts, and collect real-time data on customer spending habits for targeted marketing. This method also provides additional security with biometric authentication and encrypted payment codes, catering to customers who prefer cashless transactions and improving conversion rates."

Banks

Banks leverage digital wallets for a convenient and secure payment method, allowing customers to manage finances and make payments from their mobile devices. Biometric authentication and encrypted payment codes provide additional security. Digital wallets expand services to reach unbanked customers, offering a seamless and modern banking experience."

Travel And Transportation

The travel and transportation industry leverages digital wallets for a seamless payment experience, enabling customers to book and pay using mobile devices without cash or physical payment cards. Biometric authentication and encrypted payment codes offer secure payment methods. Digital wallets improve customer experience and cater to cashless transactions.

Retail

Many retail stores are accepting digital wallets as a payment option to provide customers with a faster, more secure checkout experience. Digital wallets also allow retailers to collect valuable data on customer spending habits for targeted marketing campaigns.

Food Delivery

Food delivery services and restaurants are using digital wallets to streamline the payment process for online and mobile orders. Digital wallets enable customers to pay for their orders quickly and easily without the need for cash or payment cards.

Entertainment

Digital wallets are becoming more prevalent in the entertainment industry, with many companies accepting them as a payment option for ticket sales, online subscriptions, and in-app purchases. Digital wallets also offer a more secure payment method for customers.

Healthcare

Digital wallets are being used in the healthcare industry to enable patients to pay for medical bills and insurance premiums conveniently and securely. They also allow healthcare providers to streamline payment processing and reduce administrative costs.

Reason To Invest In Digital Wallet App Development

Did you know the US mobile payment market is the second largest at $465.1 bn worth of transactions?The revenue of digital wallets in North America is expected to grow to more than $80bn by 2026. You may even have encountered apps like Cash App, Venmo, and Zelle, widely popular and facilitating equally seamless and secure transaction processes, making a breakthrough in the USA eCommerce industry. Investing in your business's digital wallet app development in 2024 presents significant opportunities to attract new customers, foster loyalty, and open new revenue streams. Let's explore the key drivers behind digital wallet app development in 2024.

Rise In Contactless Payment

Today's consumer is more inclined towards digital experiences. It is driving the need for eWallets. These eWallets promote contactless payment and provide the speed and security modern consumers expect from businesses.

Evolving With Cloud

Right from development to deployment to hosting, the built-in capabilities of the cloud allow building mobile wallet apps that leverage intense computation and advanced scalability. Cloud also fosters encrypted algorithms and enhanced platform security. By leveraging the advantages of the cloud, businesses can take their digital wallet to places, support integration, and add new functionalities to traditional banking, which were impossible before with dated solutions.

Core Processes Improvement

Developing a digital wallet allows businesses to respond to more flexible and personalized transactions than modern consumers expect. Companies can transform their core processes by expanding their capabilities and merging the payment processes into one cohesive system.

What Is The Cost Of A Digital Wallet App Development?

A digital wallet app development cost depends on several factors such as mobile platform, application features, development time and stages, developer’s location, application’s hosting, business model, and others. Therefore, it is highly recommended that you first discuss the project roadmap and list of core features with your digital wallet development company as it helps you get a detailed estimation for the product development. Still, to give you a better picture of what constitutes to digital wallet app development cost, here is a detailed list of contributing factors:

- The platform or smart device for which you want to develop the app

- Application's core features and complexity

- Developer's experience and expertise

- UI/UX development cost

- Hosting and infrastructure costs

- Number of screens you want to address

- Application testing and post-app launch maintenance and support

- Developer's location, team size, and taxes

However, the cost to build a digital wallet for Android often ranges between $20,000 and $50,000. On the other hand, going with a mobile wallet app development for iOS ranges between $30,000 to $60,000. These numbers provide a rough estimate of wallet app development but it could increase based on the features and functionalities you would like to be added to your application.Also read - How Much Does It Cost to Make an App?

Our Expertise In Creating Digital Wallet Apps

At Successive, we provide end-to-end digital wallet app development services to build that dream eWallet. To develop a unique digital wallet solution for your business, we abide by compliance and security best practices that instill confidence within users to use your eWallet solution for all sorts of online payment transactions.We keep your business' needs at forefront and back it up with latest technologies including cloud hosting and deployment, providing you faster go to market, scalable integrations, and continuous innovation.

Conclusion

When you are creating a digital wallet, it's important to consider how people will use it and what features it should have. You'll need to choose the right type of app for your target audience. And most importantly, you should focus on making the customer experience as enjoyable as possible to encourage people to use your digital wallet. To stand out from other digital wallets and capture a larger market share, it's important that you collaborate with an experienced digital wallet app development company like Successive Digital.We have helped clients with complete payment application development and integration support, hence can help you to plan and strategize every step of your product development and launch process. By leveraging our expertise and support throughout the development process, you can expand your payment options and improve customer experience.

.avif)